2

RESEARCH METHODOLOGY

78

5

MARKET OVERVIEW AND INDUSTRY TRENDS

Autonomous AI and edge capabilities drive market growth amidst legal and integration challenges.

101

5.2.1.1

GROWTH IN ADOPTION OF AUTONOMOUS ARTIFICIAL INTELLIGENCE

5.2.1.2

RISE OF DEEP LEARNING AND MACHINE LEARNING TECHNOLOGIES

5.2.1.3

ADVANCEMENTS IN COMPUTING POWER AND AVAILABILITY OF LARGE DATABASES

5.2.2.1

INCREASING CONCERNS OVER IP OWNERSHIP AND LEGAL RISKS IN GENERATIVE AI-GENERATED CONTENT

5.2.2.2

COST AND COMPLEXITY OF ALIGNING MODELS WITH ENTERPRISE-SPECIFIC COMPLIANCE AND GOVERNANCE POLICIES

5.2.2.3

FRAGMENTATION IN AI TOOLCHAINS AND LACK OF STANDARDIZED EVALUATION FRAMEWORKS FOR ENTERPRISE READINESS

5.2.3.1

ADVANCEMENTS IN AI-NATIVE INFRASTRUCTURE ENHANCING SCALABILITY AND PERFORMANCE

5.2.3.2

EXPANSION OF EDGE AI CAPABILITIES FOR REAL-TIME DATA PROCESSING AND DECISION-MAKING

5.2.3.3

ADVANCEMENTS IN GENERATIVE AI TO OPEN NEW AVENUES FOR AI-POWERED CONTENT CREATION

5.2.4.1

LACK OF TRANSPARENCY AND EXPLAINABILITY IN DECISION-MAKING PROCESS OF AI

5.2.4.2

CONCERNS RELATED TO BIAS AND INACCURATELY GENERATED OUTPUT

5.2.4.3

INTEGRATION CHALLENGES AND LACK OF UNDERSTANDING OF STATE- OF-THE-ART SYSTEMS

5.3

ARTIFICIAL INTELLIGENCE MARKET: EVOLUTION

5.4

SUPPLY CHAIN ANALYSIS

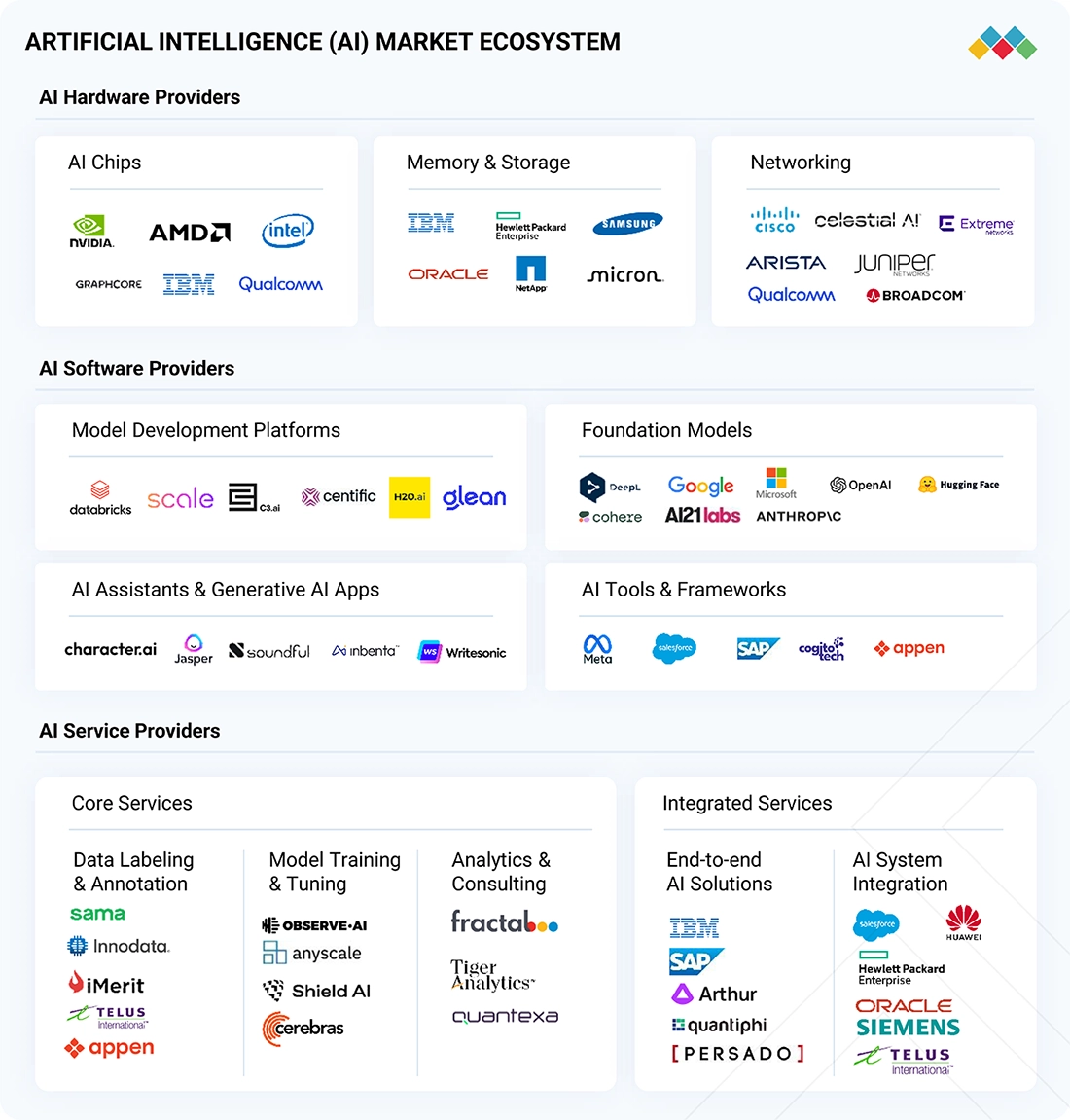

5.5.1

ARTIFICIAL INTELLIGENCE HARDWARE PROVIDERS

5.5.2

ARTIFICIAL INTELLIGENCE SOFTWARE PROVIDERS

5.5.3

ARTIFICIAL INTELLIGENCE SERVICE PROVIDERS

5.6

IMPACT OF 2025 US TARIFF – ARTIFICIAL INTELLIGENCE (AI) MARKET

5.6.3

PRICE IMPACT ANALYSIS

5.6.3.1

STRATEGIC SHIFTS AND EMERGING TRENDS

5.6.4

IMPACT ON COUNTRY/REGION

5.6.4.4

ASIA PACIFIC (EXCLUDING CHINA)

5.6.5

IMPACT ON END-USE INDUSTRIES

5.6.5.2

HEALTHCARE & LIFE SCIENCES

5.6.5.4

RETAIL & E-COMMERCE

5.6.5.5

TELECOMMUNICATIONS

5.6.5.6

TRANSPORTATION & LOGISTICS

5.6.5.7

SOFTWARE & TECHNOLOGY PROVIDERS

5.6.5.8

ENERGY & UTILITIES

5.7

INVESTMENT LANDSCAPE AND FUNDING SCENARIO

5.8.1

IBM AND VODAFONE: TRANSFORMING CUSTOMER ENGAGEMENT WITH AI-POWERED VIRTUAL ASSISTANT TOBI

5.8.2

MICROSOFT AND MARS: ADVANCING SUPPLY CHAIN OPTIMIZATION WITH AZURE MACHINE LEARNING

5.8.3

NVIDIA AND PERPLEXITY AI: BOOSTING MODEL PERFORMANCE AND COST EFFICIENCY WITH NEMO FRAMEWORK

5.8.4

OPENAI AND NOTION: POWERING INTELLIGENT PRODUCTIVITY WITH EMBEDDED AI ASSISTANTS

5.8.5

GOOGLE CLOUD AND GE APPLIANCES: DELIVERING PERSONALIZED COOKING EXPERIENCES WITH GENERATIVE AI

5.9.1.2

AUTONOMOUS AI & AUTONOMOUS AGENTS

5.9.2

COMPLEMENTARY TECHNOLOGIES

5.9.2.3

SENSORS AND ROBOTICS

5.9.3

ADJACENT TECHNOLOGIES

5.9.3.1

PREDICTIVE ANALYTICS

5.9.3.4

AUGMENTED REALITY/VIRTUAL REALITY

5.10

TARIFF AND REGULATORY LANDSCAPE

5.10.1

TARIFF RELATED TO PROCESSORS AND CONTROLLERS (HSN: 854231)

5.10.2

REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

5.10.3

REGULATIONS: ARTIFICIAL INTELLIGENCE

5.10.3.4

MIDDLE EAST & AFRICA

5.11.2

PATENTS FILED, BY DOCUMENT TYPE

5.11.3

INNOVATION AND PATENT APPLICATIONS

5.12.1

AVERAGE SELLING PRICE OF OFFERING, BY KEY PLAYER, 2025

5.12.2

AVERAGE SELLING PRICE, BY APPLICATION, 2025

5.13.1

EXPORT SCENARIO OF PROCESSORS AND CONTROLLERS

5.13.2

IMPORT SCENARIO OF PROCESSORS AND CONTROLLERS

5.14

KEY CONFERENCES AND EVENTS (2025–2026)

5.15

PORTER’S FIVE FORCES ANALYSIS

5.15.1

THREAT OF NEW ENTRANTS

5.15.2

THREAT OF SUBSTITUTES

5.15.3

BARGAINING POWER OF SUPPLIERS

5.15.4

BARGAINING POWER OF BUYERS

5.15.5

INTENSITY OF COMPETITIVE RIVALRY

5.16

KEY STAKEHOLDERS & BUYING CRITERIA

5.16.1

KEY STAKEHOLDERS IN BUYING PROCESS

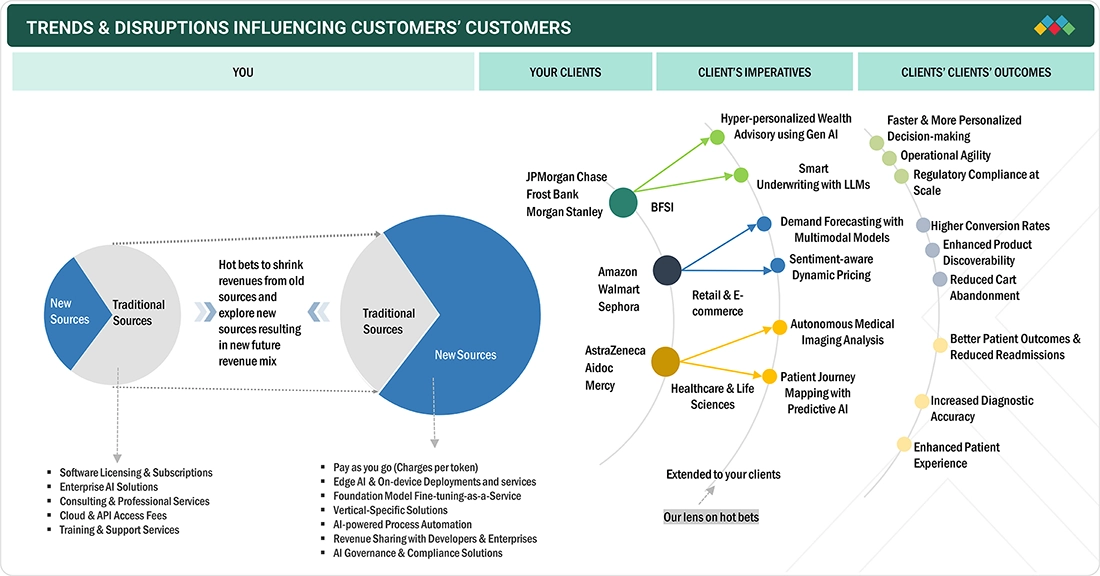

5.17

TRENDS/DISRUPTIONS IMPACTING CUSTOMERS’ BUSINESSES

5.17.1

TRENDS/DISRUPTIONS IMPACTING CUSTOMERS’ BUSINESSES

6

ARTIFICIAL INTELLIGENCE MARKET, BY OFFERING

Market Size & Growth Rate Forecast Analysis to 2032 in USD Billion and ML | 88 Data Tables

164

6.1.1

OFFERING: ARTIFICIAL INTELLIGENCE MARKET DRIVERS

6.2

INFRASTRUCTURE, BY TYPE

6.2.1

AI MARKET GROWTH DRIVEN BY ROBUST INFRASTRUCTURE

6.2.2.1

GRAPHICS PROCESSING UNIT (GPU)

6.2.2.2

CENTRAL PROCESSING UNIT (CPU)

6.2.2.3

FIELD-PROGRAMMABLE GATE ARRAY (FPGA)

6.2.3.1

DOUBLE DATA RATE (DDR)

6.2.3.2

HIGH BANDWIDTH MEMORY (HBM)

6.2.4

NETWORKING HARDWARE

6.2.4.1

NIC/NETWORK ADAPTERS

6.3

INFRASTRUCTURE, BY FUNCTION

6.3.1

INFERENCE INFRASTRUCTURE IN HIGH DEMAND AS ORGANIZATIONS MOVE TOWARD REAL-WORLD IMPLEMENTATION

6.4.1

EMPOWERING SCALABLE INTELLIGENCE WITH PURPOSE-BUILT TOOLS

6.4.2

DIGITAL ASSISTANT & BOTS

6.4.3

MACHINE LEARNING FRAMEWORKS

6.4.4

NO-CODE/LOW-CODE ML TOOLS

6.4.5

COMPUTER VISION PLATFORMS

6.4.6

DATA PRE-PROCESSING TOOLS

6.4.7

BUSINESS INTELLIGENCE & ANALYTICS PLATFORMS

6.4.8

DEVELOPER PLATFORMS

6.5.1

POWERING AI SYSTEMS THROUGH STRUCTURED AND GOVERNED DATA

6.5.2.1

DATA COLLECTION & INGESTION

6.5.2.2

DATA PROCESSING & TRANSFORMATION

6.5.2.3

DATA STORAGE & MANAGEMENT

6.5.2.4

DATA SECURITY & PRIVACY

6.5.2.5

DATA GOVERNANCE & QUALITY MANAGEMENT

6.5.2.6

DATA INTEGRATION & INTEROPERABILITY

6.5.2.7

DATA ANNOTATION & TRAINING DATA SERVICES

6.5.3

INTEGRATED SERVICES

6.5.3.1

AI MODEL DEVELOPMENT & DEPLOYMENT

6.5.3.2

AI MODEL OPTIMIZATION & FINE-TUNING

6.5.3.3

AI SECURITY & COMPLIANCE SERVICES

6.5.3.4

AI SOFTWARE DEVELOPMENT SERVICES

6.5.3.5

SUPPORT & MAINTENANCE SERVICES

7

ARTIFICIAL INTELLIGENCE MARKET, BY TECHNOLOGY

AI Market Size & Growth Rate Forecast Analysis to 2032 in USD Billion | 38 Data Tables

209

7.1.1

TECHNOLOGY: ARTIFICIAL INTELLIGENCE MARKET DRIVERS

7.2.1

STRATEGIC ROLE OF MACHINE LEARNING IN ENTERPRISE AI

7.2.2

SUPERVISED LEARNING

7.2.3

UNSUPERVISED LEARNING

7.2.4

REINFORCEMENT LEARNING

7.3

NATURAL LANGUAGE PROCESSING

7.3.1

UNLOCKING BUSINESS VALUE FROM UNSTRUCTURED AND MULTILINGUAL DATA

7.3.2

NATURAL LANGUAGE UNDERSTANDING

7.3.3

NATURAL LANGUAGE GENERATION

7.4.1

COMPUTER VISION AI TRANSLATES VISUAL DATA INTO REAL-TIME, ACTIONABLE INSIGHTS

7.4.3

IMAGE CLASSIFICATION

7.4.4

SEMANTIC SEGMENTATION

7.4.6

OTHER COMPUTER VISION AI

7.5

CONTEXT-AWARE ARTIFICIAL INTELLIGENCE

7.5.1

VIRTUAL ASSISTANTS MAINTAIN CONTINUITY AND INTENT ACROSS INTERACTIONS AND PLATFORMS

7.5.2

CONTEXT-AWARE RECOMMENDATION SYSTEMS

7.5.4

CONTEXT-AWARE VIRTUAL ASSISTANTS

7.6.1

DEEP LEARNING MODELS ENABLE MACHINES TO PRODUCE CONTEXTUALLY RELEVANT AND REALISTIC OUTPUTS

8

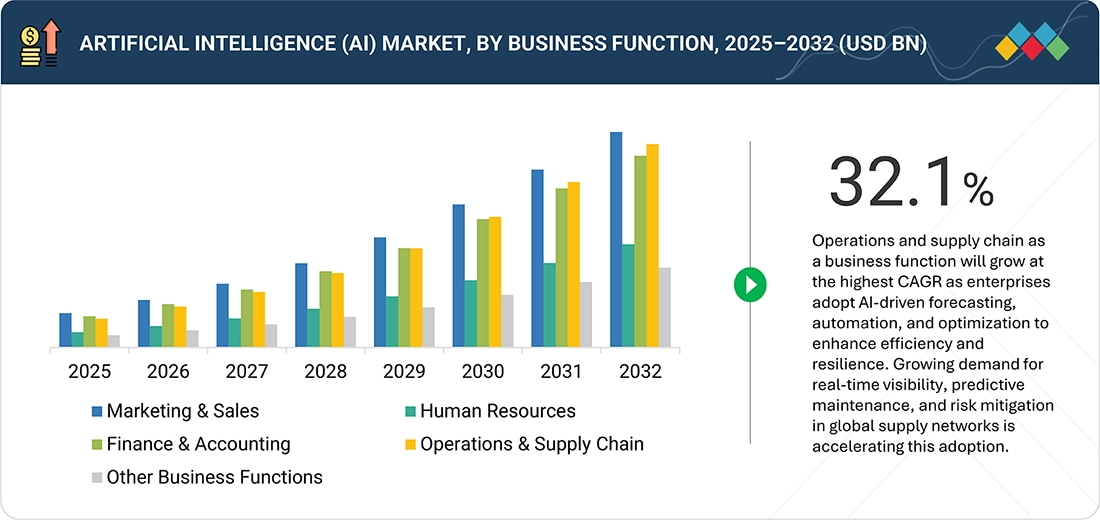

ARTIFICIAL INTELLIGENCE MARKET, BY BUSINESS FUNCTION

Market Size & Growth Rate Forecast Analysis to 2032 in USD Billion | 62 Data Tables

230

8.1.1

BUSINESS FUNCTION: ARTIFICIAL INTELLIGENCE MARKET DRIVERS

8.2.1

PERSONALIZING MARKETING EFFORTS THROUGH CONTENT AND AUDIENCE SEGMENTATION

8.2.3

PREDICTIVE FORECASTING

8.2.4

CONTENT GENERATION & MARKETING

8.2.5

AUDIENCE SEGMENTATION & PERSONALIZATION

8.2.6

CUSTOMER EXPERIENCE MANAGEMENT

8.2.7

OTHER MARKETING & SALES FUNCTIONS

8.3.1

ALIGNING EMPLOYEE PERFORMANCE WITH ORGANIZATIONAL GOALS USING AI

8.3.2

ONBOARDING AUTOMATION

8.3.3

CANDIDATE SCREENING & RECRUITMENT

8.3.4

PERFORMANCE MANAGEMENT

8.3.5

WORKFORCE MANAGEMENT

8.3.6

EMPLOYEE FEEDBACK ANALYSIS

8.3.7

OTHER HUMAN RESOURCES FUNCTIONS

8.4.1

ENHANCING FORECASTING AND FINANCIAL PLANNING WITH AI

8.4.2

FINANCIAL PLANNING & FORECASTING

8.4.3

AUTOMATED BOOKKEEPING & RECONCILIATION

8.4.4

PROCUREMENT & SUPPLY CHAIN FINANCE

8.4.5

REVENUE CYCLE MANAGEMENT

8.4.6

FINANCIAL COMPLIANCE & REGULATORY REPORTING

8.4.7

OTHER FINANCE & ACCOUNTING FUNCTIONS

8.5

OPERATIONS & SUPPLY CHAIN

8.5.1

ACCURATE DEMAND FORECASTING WITH AI FOR SMARTER PLANNING

8.5.3

IT SERVICE MANAGEMENT

8.5.4

DEMAND PLANNING & FORECASTING

8.5.5

PROCUREMENT & SOURCING

8.5.6

WAREHOUSE & INVENTORY MANAGEMENT

8.5.7

PRODUCTION PLANNING & SCHEDULING

8.5.8

OTHER OPERATIONS & SUPPLY CHAIN FUNCTIONS

8.6

OTHER BUSINESS FUNCTIONS

9

ARTIFICIAL INTELLIGENCE MARKET, BY ENTERPRISE APPLICATION

Market Size & Growth Rate Forecast Analysis to 2032 in USD Billion | 48 Data Tables

263

9.1.1

ENTERPRISE APPLICATION: ARTIFICIAL INTELLIGENCE MARKET DRIVERS

9.2.1

ADOPTION OF AI IN BFSI DRIVEN BY RISING DATA VOLUMES, REGULATORY COMPLEXITY, AND EVOLVING CUSTOMER EXPECTATIONS

9.2.2

FRAUD DETECTION AND PREVENTION

9.2.3

RISK ASSESSMENT AND MANAGEMENT

9.2.4

ALGORITHMIC TRADING

9.2.5

CREDIT SCORING AND UNDERWRITING

9.2.6

CUSTOMER SERVICE AUTOMATION

9.2.7

PERSONALIZED FINANCIAL RECOMMENDATIONS

9.2.8

INVESTMENT PORTFOLIO MANAGEMENT

9.2.9

REGULATORY COMPLIANCE MONITORING

9.2.10

OTHER BFSI APPLICATIONS

9.3.1

PRICE OPTIMIZATION AND SUPPLY CHAIN MANAGEMENT-LIKE FUNCTIONS BEING REVOLUTIONIZED THROUGH PREDICTIVE ALGORITHMS AND REAL-TIME ANALYTICS

9.3.2

PERSONALIZED PRODUCT RECOMMENDATION

9.3.3

CUSTOMER RELATIONSHIP MANAGEMENT

9.3.5

VIRTUAL CUSTOMER ASSISTANT

9.3.7

SUPPLY CHAIN MANAGEMENT & DEMAND PLANNING

9.3.9

OTHER RETAIL & E-COMMERCE APPLICATIONS

9.4

TRANSPORTATION & LOGISTICS

9.4.1

SUPPLY CHAIN VISIBILITY AND TRACKING ENHANCED THROUGH AI-DRIVEN REAL-TIME MONITORING AND PREDICTIVE ANALYTICS

9.4.3

DRIVER ASSISTANCE SYSTEM

9.4.4

SEMI-AUTONOMOUS & AUTONOMOUS VEHICLES

9.4.5

INTELLIGENT TRAFFIC MANAGEMENT

9.4.6

SMART LOGISTICS AND WAREHOUSING

9.4.7

SUPPLY CHAIN VISIBILITY AND TRACKING

9.4.9

OTHER TRANSPORTATION AND LOGISTICS APPLICATIONS

9.5.1

AI STRENGTHENS COMMAND AND CONTROL SYSTEMS BY INTEGRATING DATA FOR UNIFIED OPERATIONAL VIEWS AND STRATEGIC DECISIONS

9.5.2

SURVEILLANCE AND SITUATIONAL AWARENESS

9.5.4

INTELLIGENCE ANALYSIS AND DATA PROCESSING

9.5.5

SIMULATION AND TRAINING

9.5.6

COMMAND AND CONTROL

9.5.7

DISASTER RESPONSE AND RECOVERY ASSISTANCE

9.5.8

E-GOVERNANCE AND DIGITAL CITY SERVICES

9.5.9

OTHER GOVERNMENT & DEFENSE APPLICATIONS

9.6

HEALTHCARE & LIFE SCIENCES

9.6.1

AI EXTENDS ITS IMPACT INTO DRUG DISCOVERY, VIRTUAL CARE, AND MEDICAL RESEARCH

9.6.2

PATIENT DATA AND RISK ANALYSIS

9.6.3

LIFESTYLE MANAGEMENT AND MONITORING

9.6.5

INPATIENT CARE AND HOSPITAL MANAGEMENT

9.6.6

MEDICAL IMAGING AND DIAGNOSTICS

9.6.8

AI-ASSISTED MEDICAL SERVICES

9.6.10

OTHER HEALTHCARE & LIFE SCIENCES APPLICATIONS

9.7.1

TELECOM OPERATORS TURNING TO AI TO ENHANCE AGILITY, REDUCE OPERATIONAL COSTS, AND DELIVER SUPERIOR USER EXPERIENCES

9.7.2

NETWORK OPTIMIZATION

9.7.4

CUSTOMER SERVICE AND SUPPORT

9.7.6

INTELLIGENT CALL ROUTING

9.7.7

NETWORK FAULT PREDICTION

9.7.8

VIRTUAL NETWORK ASSISTANTS

9.7.9

VOICE AND SPEECH RECOGNITION

9.7.10

OTHER TELECOMMUNICATIONS APPLICATIONS

9.8.1

ADVANCED MACHINE LEARNING ALGORITHMS AND EDGE AI PLATFORMS ENABLING REAL-TIME OPTIMIZATION AND PREDICTIVE MAINTENANCE

9.8.2

ENERGY DEMAND FORECASTING

9.8.3

GRID OPTIMIZATION AND MANAGEMENT

9.8.4

ENERGY CONSUMPTION ANALYTICS

9.8.5

SMART METERING AND ENERGY DATA MANAGEMENT

9.8.6

ENERGY STORAGE OPTIMIZATION

9.8.7

REAL-TIME ENERGY MONITORING AND CONTROL

9.8.8

POWER QUALITY MONITORING AND MANAGEMENT

9.8.9

ENERGY TRADING AND MARKET FORECASTING

9.8.10

INTELLIGENT ENERGY MANAGEMENT SYSTEMS

9.8.11

OTHER ENERGY & UTILITIES APPLICATIONS

9.9.1

AI SUPPORTS SUSTAINABLE MANUFACTURING THROUGH RECYCLABLE MATERIAL RECLAMATION

9.9.2

MATERIAL MOVEMENT MANAGEMENT

9.9.3

PREDICTIVE MAINTENANCE AND MACHINERY INSPECTION

9.9.4

PRODUCTION PLANNING

9.9.5

RECYCLABLE MATERIAL RECLAMATION

9.9.6

PRODUCTION LINE OPTIMIZATION

9.9.8

INTELLIGENT INVENTORY MANAGEMENT

9.9.9

OTHER MANUFACTURING APPLICATIONS

9.10.1

AI’S GROWING INFLUENCE IN AGRICULTURE NECESSARY STEP TOWARD FUTURE-READY FARMING SYSTEMS

9.10.2

CROP MONITORING AND YIELD PREDICTION

9.10.4

SOIL ANALYSIS AND NUTRIENT MANAGEMENT

9.10.5

PEST AND DISEASE DETECTION

9.10.6

IRRIGATION OPTIMIZATION AND WATER MANAGEMENT

9.10.7

AUTOMATED HARVESTING AND SORTING

9.10.8

WEED DETECTION AND MANAGEMENT

9.10.9

WEATHER AND CLIMATE MONITORING

9.10.10

LIVESTOCK MONITORING AND HEALTH MANAGEMENT

9.10.11

OTHER AGRICULTURE APPLICATIONS

9.11

SOFTWARE & TECHNOLOGY PROVIDERS

9.11.1

FROM INTELLIGENT AUTOMATION TO ROBUST SECURITY, AI IS REDEFINING SOFTWARE CAPABILITIES

9.11.2

CODE GENERATION & AUTO-COMPLETION

9.11.3

BUG DETECTION & FIXING

9.11.4

AUTOMATED SOFTWARE TESTING & QA

9.11.5

AI-POWERED CYBERSECURITY & THREAT DETECTION

9.11.6

AUTOMATED DEVOPS & CI/CD OPTIMIZATION

9.11.7

OTHER SOFTWARE & TECHNOLOGY PROVIDERS APPLICATIONS

9.12

MEDIA AND ENTERTAINMENT

9.12.1

FROM PERSONALIZED CONTENT TO COPYRIGHT PROTECTION, AI TO RESHAPE DIGITAL MEDIA STRATEGIES

9.12.2

CONTENT RECOMMENDATION SYSTEMS

9.12.3

CONTENT CREATION AND GENERATION

9.12.4

CONTENT COPYRIGHT PROTECTION

9.12.5

AUDIENCE ANALYTICS AND SEGMENTATION

9.12.6

PERSONALIZED ADVERTISING

9.12.7

OTHER MEDIA AND ENTERTAINMENT APPLICATIONS

9.13

OTHER ENTERPRISE APPLICATIONS

10

ARTIFICIAL INTELLIGENCE MARKET, BY END USER

Market Size & Growth Rate Forecast Analysis to 2032 in USD Billion | 30 Data Tables

318

10.1.1

END USER: ARTIFICIAL INTELLIGENCE MARKET DRIVERS

10.2.1

AI INTEGRATION INTO SMART ASSISTANTS, AND CREATIVE CONTENT GENERATION TOOLS DRIVING RAPID CONSUMER ADOPTION

10.3.1.1

INCREASED USE OF AI FOR FRAUD DETECTION, PERSONALIZED FINANCIAL SERVICES, AND REAL-TIME RISK MANAGEMENT IN BFSI

10.3.1.3

FINANCIAL SERVICES

10.3.2

RETAIL & E-COMMERCE

10.3.2.1

AI-POWERED RECOMMENDATION ENGINES, PERSONALIZED MARKETING, AND DYNAMIC PRICING ARE TRANSFORMING CONSUMER EXPERIENCES

10.3.2.2

CONSUMER GOODS RETAIL

10.3.2.3

INDUSTRIAL GOODS RETAIL

10.3.3

TRANSPORTATION & LOGISTICS

10.3.3.1

AI IS OPTIMIZING ROUTE PLANNING AND SUPPLY CHAIN VISIBILITY, ENABLING COST-EFFECTIVE AND RESPONSIVE TRANSPORTATION SYSTEMS

10.3.4

GOVERNMENT & DEFENSE

10.3.4.1

AI IS ENABLING SMARTER PUBLIC SERVICES, ENHANCED SECURITY, AND IMPROVED DECISION-MAKING IN GOVERNMENT OPERATIONS

10.3.4.2

FEDERAL GOVERNMENT

10.3.4.3

STATE & LOCAL GOVERNMENTS

10.3.4.4

MILITARY & DEFENSE

10.3.4.5

PUBLIC SERVICE AGENCIES

10.3.5

HEALTHCARE & LIFE SCIENCES

10.3.5.1

AI TRANSFORMING CLINICAL AND OPERATIONAL ASPECTS OF HEALTHCARE THROUGH RAPID DRUG DISCOVERY AND IMPROVING DIAGNOSTIC ACCURACY

10.3.5.2

HEALTHCARE PROVIDERS

10.3.5.3

PHARMACEUTICALS & BIOTECH SECTOR

10.3.6

TELECOMMUNICATIONS

10.3.6.1

TELECOM PROVIDERS ARE LEVERAGING AI TO OPTIMIZE THEIR INFRASTRUCTURE AND SERVICES VIA AUTONOMOUS NETWORK MANAGEMENT

10.3.6.2

NETWORK OPERATORS

10.3.6.3

TELECOM EQUIPMENT PROVIDERS

10.3.6.4

COMMUNICATION SERVICE PROVIDERS (CSPS)

10.3.6.5

DATA & CLOUD CONNECTIVITY PROVIDERS

10.3.7

ENERGY & UTILITIES

10.3.7.1

AI-DRIVEN ENERGY OPTIMIZATION, PREDICTIVE MAINTENANCE, AND GRID MANAGEMENT ARE SUPPORTING THE TRANSITION TO RENEWABLE ENERGY

10.3.7.3

POWER GENERATION

10.3.8.1

PREDICTIVE MAINTENANCE, SMART FACTORIES, AND AUTOMATION OF PRODUCTION LINES THROUGH AI ARE ENHANCING PRODUCTIVITY AND REDUCING DOWNTIME

10.3.8.2

DISCRETE MANUFACTURING

10.3.8.3

PROCESS MANUFACTURING

10.3.9

SOFTWARE & TECHNOLOGY PROVIDERS

10.3.9.1

AI-DRIVEN INFRASTRUCTURE AND GENERATIVE AI TOOLS ARE EMPOWERING SOFTWARE & TECH PLAYERS TO INTEGRATE AI INTO PRODUCTS AND SERVICES

10.3.9.2

CLOUD HYPERSCALERS

10.3.9.3

FOUNDATION MODEL/LLM PROVIDERS

10.3.9.4

AI TECHNOLOGY PROVIDERS

10.3.9.5

IT & IT-ENABLED SERVICE PROVIDERS (ITES)

10.3.10

MEDIA AND ENTERTAINMENT

10.3.10.1

GENERATIVE AI TOOLS FOR CONTENT CREATION AND REAL-TIME PERSONALIZATION ARE ACCELERATING INNOVATION AND COST REDUCTION IN MEDIA INDUSTRIES

10.3.10.2

PUBLISHING & JOURNALISM

10.3.10.3

TELEVISION, FILM & OTT

10.3.10.5

GAMING & INTERACTIVE MEDIA

10.3.10.6

ADVERTISING & MARKETING AGENCIES

10.3.10.7

OTHER MEDIA & ENTERTAINMENT ENTERPRISES

10.3.11

OTHER ENTERPRISES

10.3.11.1

AI APPLICATIONS LIKE PERSONALIZED LEARNING, AUDIENCE ENGAGEMENT, AND OPERATIONAL OPTIMIZATION ARE DRIVING EFFICIENCIES

11

ARTIFICIAL INTELLIGENCE MARKET, BY REGION

Comprehensive coverage of 7 Regions with country-level deep-dive of 23 Countries | 388 Data Tables.

346

11.2.1

NORTH AMERICA: ARTIFICIAL INTELLIGENCE MARKET DRIVERS

11.2.2

NORTH AMERICA: MACROECONOMIC OUTLOOK

11.2.3.1

GROWTH INITIATIVES BY US GOVERNMENT AND BUSINESSES TO DRIVE MARKET GROWTH

11.2.4.1

RISE IN FUNDING FOR BUILDING TRANSFORMATIONAL PUBLIC COMPUTING INFRASTRUCTURE

11.3.1

EUROPE: ARTIFICIAL INTELLIGENCE MARKET DRIVERS

11.3.2

EUROPE: MACROECONOMIC OUTLOOK

11.3.3.1

CONTINUOUS INVESTMENTS AND INITIATIVES BY UK GOVERNMENT TO BOLSTER GROWTH OF AI MARKET

11.3.4.1

GERMANY RECOGNIZING AI AS MOST IMPORTANT FUTURE TECHNOLOGY

11.3.5.1

ACTIVE PROMOTIONS OF AI INITIATIVES AND INVESTMENTS IN RESEARCH AND DEVELOPMENT TO PUSH FRENCH MARKET FORWARD

11.3.6.1

ADOPTION OF SOPHISTICATED TECHNOLOGIES WITH THRIVING STARTUP ECOSYSTEM IN ITALY TO DRIVE AI MARKET GROWTH

11.3.7.1

INITIATIVES BY SPANISH GOVERNMENT TO PROMOTE WIDESPREAD ADOPTION OF ARTIFICIAL INTELLIGENCE

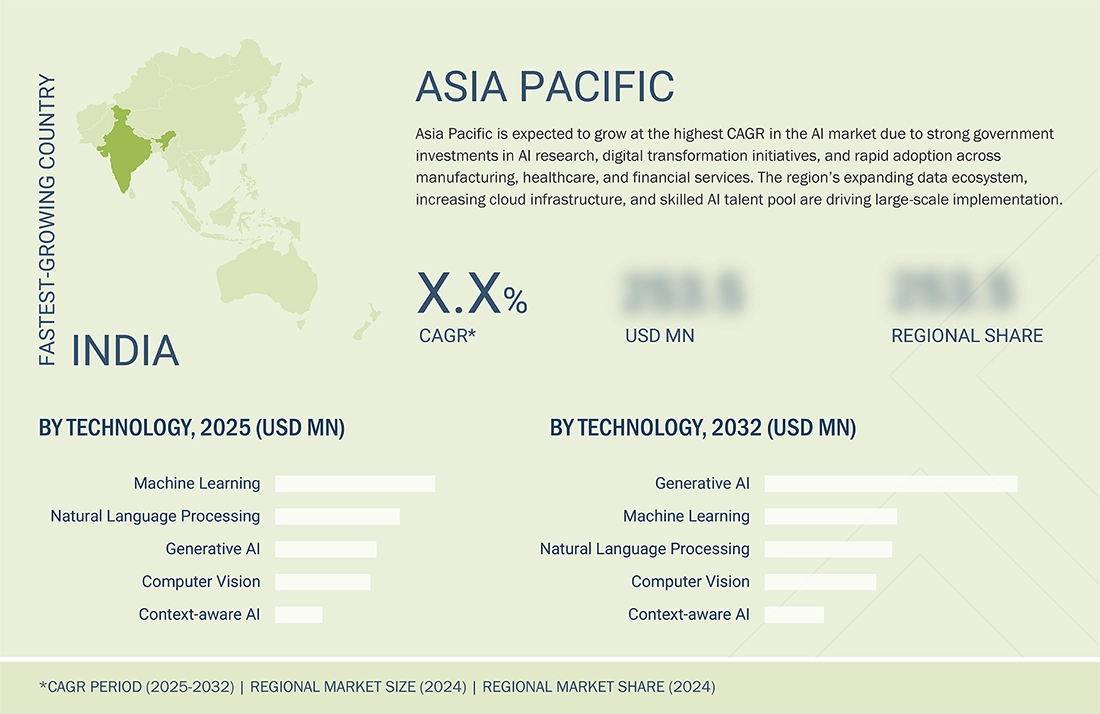

11.4.1

ASIA PACIFIC: ARTIFICIAL INTELLIGENCE MARKET DRIVERS

11.4.2

ASIA PACIFIC: MACROECONOMIC OUTLOOK

11.4.3.1

GOVERNMENT INITIATIVES AND REGULATIONS IN FAVOR OF AI DEVELOPMENT IN CHINA TO DRIVE MARKET GROWTH

11.4.4.1

EXPLORING GENERATIVE AI FOR INNOVATION AND INDUSTRY TRANSFORMATION IN INDIA TO DRIVE MARKET GROWTH

11.4.5.1

JAPAN’S DIVERSE ECOSYSTEM OF STARTUPS AND ESTABLISHED TECH GIANTS TO DRIVE INNOVATION

11.4.6.1

GOVERNMENT INVESTMENTS IN ARTIFICIAL INTELLIGENCE INFRASTRUCTURE TO ENHANCE CITIZEN SERVICES IN SOUTH KOREA

11.4.7

AUSTRALIA & NEW ZEALAND

11.4.7.1

BUSINESS EXPERIMENTS WITH GEN AI APPLICATIONS TO ANALYZE VAST AMOUNTS OF DATA AND EXTRACT INSIGHTS

11.4.9

REST OF ASIA PACIFIC

11.5

MIDDLE EAST & AFRICA

11.5.1

MIDDLE EAST & AFRICA: ARTIFICIAL INTELLIGENCE MARKET DRIVERS

11.5.2

MIDDLE EAST & AFRICA: MACROECONOMIC OUTLOOK

11.5.3.1

GREATER EMPHASIS ON ARTIFICIAL INTELLIGENCE DEVELOPMENT ACROSS KEY INDUSTRY VERTICALS IN SAUDI ARABIA TO DRIVE MARKET GROWTH

11.5.4.1

IMPLEMENTING PROACTIVE STRATEGIES AND ESTABLISHING REGULATORY FRAMEWORKS FOR AI ADOPTION TO DRIVE MARKET GROWTH

11.5.5.1

COLLABORATIONS AND INVESTMENTS TO BOOST STARTUP ECOSYSTEM GROWTH

11.5.6.1

TURKISH GOVERNMENT FOSTERING INNOVATION AND INTERNATIONAL COLLABORATIONS TO DRIVE ECONOMIC GROWTH

11.5.7.1

ROBUST AND RESILIENT PHYSICAL AND DIGITAL INFRASTRUCTURE TO BE KEY ENABLER FOR QATAR’S ECONOMIC DEVELOPMENT

11.5.8.1

GOVERNMENT’S STRATEGIC FOCUS ON DIGITAL TRANSFORMATION AND INNOVATION TO DRIVE AI MARKET TRENDS IN EGYPT

11.5.9.1

RISING NUMBER OF INVESTMENTS IN AI TECHNOLOGIES AND GOVERNMENT INITIATIVES TO PUSH MARKET IN KUWAIT

11.5.10

REST OF MIDDLE EAST & AFRICA

11.6.1

LATIN AMERICA: ARTIFICIAL INTELLIGENCE MARKET DRIVERS

11.6.2

LATIN AMERICA: MACROECONOMIC OUTLOOK

11.6.3.1

STRONG GOVERNMENTAL SUPPORT AND GROWING INTEREST FROM PRIVATE ENTERPRISES TO BOOST AI MARKET IN BRAZIL

11.6.4.1

MEXICO TO BECOME DIGITALLY ADVANCED COUNTRY DUE TO ADOPTION OF AI

11.6.5.1

ADOPTION OF ARTIFICIAL INTELLIGENCE TO ENHANCE PROCESSES AND IMPROVE DECISION-MAKING OF BUSINESSES IN ARGENTINA

11.6.6.1

RISE IN ADOPTION OF ARTIFICIAL INTELLIGENCE TO PROMOTE RESEARCH AND INNOVATION CENTERED AROUND HUMAN WELL-BEING TO DRIVE MARKET GROWTH

11.6.7

REST OF LATIN AMERICA

12

COMPETITIVE LANDSCAPE

Discover how AI giants are reshaping market dynamics through strategic innovation and competitive positioning.

519

12.2

KEY PLAYER STRATEGIES, 2020–2024

12.3

REVENUE ANALYSIS, 2020–2024

12.4

MARKET SHARE ANALYSIS, 2024

12.4.1

MARKET RANKING ANALYSIS, 2024

12.5

PRODUCT COMPARATIVE ANALYSIS

12.5.1

PRODUCT COMPARATIVE ANALYSIS, BY MACHINE LEARNING

12.5.1.5

MICROSOFT AZURE AI PERSONALIZER

12.5.2

PRODUCT COMPARATIVE ANALYSIS, BY NATURAL LANGUAGE PROCESSING

12.5.2.3

GOOGLE CLOUD NATURAL LANGUAGE

12.5.2.5

AMAZON COMPREHEND

12.5.3

PRODUCT COMPARATIVE ANALYSIS, BY COMPUTER VISION

12.6

COMPANY VALUATION AND FINANCIAL METRICS

12.7

COMPANY EVALUATION MATRIX: KEY PLAYERS (AI INFRASTRUCTURE), 2024

12.7.5

COMPANY FOOTPRINT: KEY PLAYERS (AI INFRASTRUCTURE), 2024

12.7.5.1

COMPANY FOOTPRINT

12.7.5.2

OFFERING FOOTPRINT

12.7.5.3

TECHNOLOGY FOOTPRINT

12.7.5.4

ENTERPRISE APPLICATION FOOTPRINT

12.7.5.5

REGION FOOTPRINT

12.8

COMPANY EVALUATION MATRIX: KEY PLAYERS (AI SOFTWARE), 2024

12.8.5

COMPANY FOOTPRINT: KEY PLAYERS (AI SOFTWARE), 2024

12.8.5.1

COMPANY FOOTPRINT

12.8.5.2

OFFERING FOOTPRINT

12.8.5.3

TECHNOLOGY FOOTPRINT

12.8.5.4

ENTERPRISE APPLICATION FOOTPRINT

12.8.5.5

REGION FOOTPRINT

12.9

COMPANY EVALUATION MATRIX: KEY PLAYERS (AI SERVICES), 2024

12.9.5

COMPANY FOOTPRINT: KEY PLAYERS (AI SERVICES), 2024

12.9.5.1

COMPANY FOOTPRINT

12.9.5.2

OFFERING FOOTPRINT

12.9.5.3

TECHNOLOGY FOOTPRINT

12.9.5.4

ENTERPRISE APPLICATION FOOTPRINT

12.9.5.5

REGION FOOTPRINT

12.10

COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2024

12.10.1

STARTUPS/SMES – AI SOFTWARE PLAYERS

12.10.1.1

PROGRESSIVE COMPANIES

12.10.1.2

RESPONSIVE COMPANIES

12.10.1.3

DYNAMIC COMPANIES

12.10.1.4

STARTING BLOCKS

12.10.2

STARTUPS/SMES – AI SERVICES PROVIDERS

12.10.2.1

PROGRESSIVE COMPANIES

12.10.2.2

RESPONSIVE COMPANIES

12.10.2.3

DYNAMIC COMPANIES

12.10.2.4

STARTING BLOCKS

12.10.3

COMPETITIVE BENCHMARKING: STARTUPS/SMES, 2024

12.10.3.1

DETAILED LIST OF KEY STARTUPS/SMES

12.10.3.2

COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES

12.11

COMPETITIVE SCENARIO AND TRENDS

12.11.1

PRODUCT LAUNCHES AND ENHANCEMENTS

13

COMPANY PROFILES

In-depth Company Profiles of Leading Market Players with detailed Business Overview, Product and Service Portfolio, Recent Developments, and Unique Analyst Perspective (MnM View)

628

13.2.1.1

BUSINESS OVERVIEW

13.2.1.2

PRODUCTS OFFERED

13.2.1.3

RECENT DEVELOPMENTS

13.2.26

TELUS INTERNATIONAL

13.2.28

FRACTAL ANALYTICS

13.3

STARTUP/SME PROFILES

13.3.12

METROPOLIS TECHNOLOGIES

13.3.34

HQE SYSTEMS, INC.

14

ADJACENT AND RELATED MARKETS

828

14.2

CONVERSATIONAL AI MARKET – GLOBAL FORECAST TO 2030

14.2.2.1

CONVERSATIONAL AI MARKET, BY OFFERING

14.2.2.2

CONVERSATIONAL AI MARKET, BY SERVICE

14.2.2.3

CONVERSATIONAL AI MARKET, BY BUSINESS FUNCTION

14.2.2.4

CONVERSATIONAL AI MARKET, BY CONVERSATIONAL AGENT TYPE

14.2.2.5

CONVERSATIONAL AI MARKET, BY INTEGRATION MODE

14.2.2.6

CONVERSATIONAL AI MARKET, BY VERTICAL

14.2.2.7

CONVERSATIONAL AI MARKET, BY REGION

14.3

GENERATIVE AI MARKET – GLOBAL FORECAST TO 2030

14.3.2.1

GENERATIVE AI MARKET, BY OFFERING

14.3.2.2

GENERATIVE AI MARKET, BY DATA MODALITY

14.3.2.3

GENERATIVE AI MARKET, BY APPLICATION

14.3.2.4

GENERATIVE AI MARKET, BY END USER

14.3.2.5

GENERATIVE AI MARKET, BY REGION

15.2

KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

15.3

CUSTOMIZATION OPTIONS

TABLE 1

ARTIFICIAL INTELLIGENCE MARKET SEGMENTATION

TABLE 2

UNITED STATES DOLLAR EXCHANGE RATE, 2020–2024

TABLE 3

PRIMARY INTERVIEWS

TABLE 5

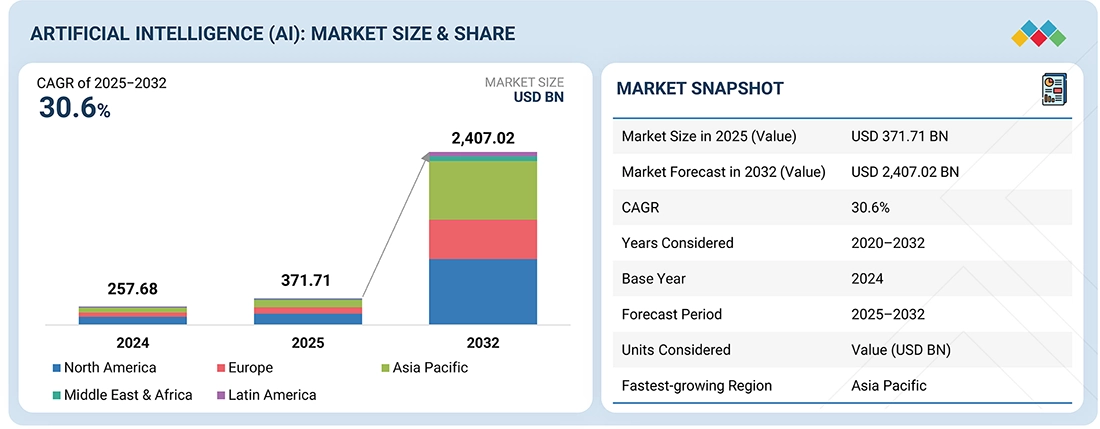

GLOBAL ARTIFICIAL INTELLIGENCE MARKET SIZE AND GROWTH RATE, 2020–2024 (USD BILLION, Y-O-Y %)

TABLE 6

GLOBAL ARTIFICIAL INTELLIGENCE MARKET SIZE AND GROWTH RATE, 2025–2032 (USD BILLION, Y-O-Y %)

TABLE 7

ARTIFICIAL INTELLIGENCE (AI) MARKET: ECOSYSTEM

TABLE 8

US ADJUSTED RECIPROCAL TARIFF RATES

TABLE 9

TARIFF RELATED TO AI PROCESSORS AND CONTROLLERS (HSN: 854231), 2024

TABLE 10

NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 11

EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 12

ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 13

MIDDLE EAST & AFRICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 14

LATIN AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 15

PATENTS FILED, 2016–2025

TABLE 16

LIST OF FEW PATENTS IN ARTIFICIAL INTELLIGENCE MARKET, 2024–2025

TABLE 17

AVERAGE SELLING PRICE OF OFFERING, BY KEY PLAYER, 2025

TABLE 18

AVERAGE SELLING PRICE, BY APPLICATION, 2025

TABLE 19

ARTIFICIAL INTELLIGENCE (AI) MARKET: DETAILED LIST OF CONFERENCES & EVENTS, 2025–2026

TABLE 20

PORTERS’ FIVE FORCES’ IMPACT ON ARTIFICIAL INTELLIGENCE (AI) MARKET

TABLE 21

INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE VERTICALS

TABLE 22

KEY BUYING CRITERIA FOR TOP THREE VERTICALS

TABLE 23

ARTIFICIAL INTELLIGENCE MARKET, BY OFFERING, 2020–2024 (USD BILLION)

TABLE 24

ARTIFICIAL INTELLIGENCE MARKET, BY OFFERING, 2025–2032 (USD BILLION)

TABLE 25

ARTIFICIAL INTELLIGENCE MARKET, BY INFRASTRUCTURE TYPE, 2020–2024 (USD BILLION)

TABLE 26

ARTIFICIAL INTELLIGENCE MARKET, BY INFRASTRUCTURE TYPE, 2025–2032 (USD BILLION)

TABLE 27

ARTIFICIAL INTELLIGENCE MARKET, BY COMPUTE, 2020–2024 (USD BILLION)

TABLE 28

ARTIFICIAL INTELLIGENCE MARKET, BY COMPUTE, 2025–2032 (USD BILLION)

TABLE 29

GPU: ARTIFICIAL INTELLIGENCE MARKET, BY REGION, 2020–2024 (USD BILLION)

TABLE 30

GPU: ARTIFICIAL INTELLIGENCE MARKET, BY REGION, 2025–2032 (USD BILLION)

TABLE 31

CPU: ARTIFICIAL INTELLIGENCE MARKET, BY REGION, 2020–2024 (USD BILLION)

TABLE 32

CPU: ARTIFICIAL INTELLIGENCE MARKET, BY REGION, 2025–2032 (USD BILLION)

TABLE 33

FPGA: ARTIFICIAL INTELLIGENCE MARKET, BY REGION, 2020–2024 (USD BILLION)

TABLE 34

FPGA: ARTIFICIAL INTELLIGENCE MARKET, BY REGION, 2025–2032 (USD BILLION)

TABLE 35

ARTIFICIAL INTELLIGENCE MARKET, BY MEMORY, 2020–2024 (USD BILLION)

TABLE 36

ARTIFICIAL INTELLIGENCE MARKET, BY MEMORY, 2025–2032 (USD BILLION)

TABLE 37

DDR: ARTIFICIAL INTELLIGENCE MARKET, BY REGION, 2020–2024 (USD BILLION)

TABLE 38

DDR: ARTIFICIAL INTELLIGENCE MARKET, BY REGION, 2025–2032 (USD BILLION)

TABLE 39

HBM: ARTIFICIAL INTELLIGENCE MARKET, BY REGION, 2020–2024 (USD BILLION)

TABLE 40

HBM: ARTIFICIAL INTELLIGENCE MARKET, BY REGION, 2025–2032 (USD BILLION)

TABLE 41

ARTIFICIAL INTELLIGENCE MARKET, BY NETWORKING HARDWARE, 2020–2024 (USD BILLION)

TABLE 42

ARTIFICIAL INTELLIGENCE MARKET, BY NETWORKING HARDWARE, 2025–2032 (USD BILLION)

TABLE 43

ARTIFICIAL INTELLIGENCE MARKET, BY NIC/NETWORK ADAPTER, 2020–2024 (USD BILLION)

TABLE 44

ARTIFICIAL INTELLIGENCE MARKET, BY NIC/NETWORK ADAPTER, 2025–2032 (USD BILLION)

TABLE 45

ETHERNET: ARTIFICIAL INTELLIGENCE MARKET, BY REGION, 2020–2024 (USD MILLION)

TABLE 46

ETHERNET: ARTIFICIAL INTELLIGENCE MARKET, BY REGION, 2025–2032 (USD MILLION)

TABLE 47

INFINIBAND: ARTIFICIAL INTELLIGENCE MARKET, BY REGION, 2020–2024 (USD MILLION)

TABLE 48

INFINIBAND: ARTIFICIAL INTELLIGENCE MARKET, BY REGION, 2025–2032 (USD MILLION)

TABLE 49

INTERCONNECTS: ARTIFICIAL INTELLIGENCE MARKET, BY REGION, 2020–2024 (USD MILLION)

TABLE 50

INTERCONNECTS: ARTIFICIAL INTELLIGENCE MARKET, BY REGION, 2025–2032 (USD MILLION)

TABLE 51

STORAGE: ARTIFICIAL INTELLIGENCE MARKET, BY REGION, 2020–2024 (USD BILLION)

TABLE 52

STORAGE: ARTIFICIAL INTELLIGENCE MARKET, BY REGION, 2025–2032 (USD BILLION)

TABLE 53

ARTIFICIAL INTELLIGENCE MARKET, BY INFRASTRUCTURE FUNCTION, 2020–2024 (USD BILLION)

TABLE 54

ARTIFICIAL INTELLIGENCE MARKET, BY INFRASTRUCTURE FUNCTION, 2025–2032 (USD BILLION)

TABLE 55

TRAINING: ARTIFICIAL INTELLIGENCE MARKET, BY REGION, 2020–2024 (USD BILLION)

TABLE 56

TRAINING: ARTIFICIAL INTELLIGENCE MARKET, BY REGION, 2025–2032 (USD BILLION)

TABLE 57

INFERENCE: ARTIFICIAL INTELLIGENCE MARKET, BY REGION, 2020–2024 (USD BILLION)

TABLE 58

INFERENCE: ARTIFICIAL INTELLIGENCE MARKET, BY REGION, 2025–2032 (USD BILLION)

TABLE 59

ARTIFICIAL INTELLIGENCE MARKET, BY SOFTWARE, 2020–2024 (USD BILLION)

TABLE 60

ARTIFICIAL INTELLIGENCE MARKET, BY SOFTWARE, 2025–2032 (USD BILLION)

TABLE 61

DIGITAL ASSISTANT & BOTS: ARTIFICIAL INTELLIGENCE MARKET, BY REGION, 2020–2024 (USD BILLION)

TABLE 62

DIGITAL ASSISTANT & BOTS: ARTIFICIAL INTELLIGENCE MARKET, BY REGION, 2025–2032 (USD BILLION)

TABLE 63

MACHINE LEARNING FRAMEWORKS: ARTIFICIAL INTELLIGENCE MARKET, BY REGION, 2020–2024 (USD BILLION)

TABLE 64

MACHINE LEARNING FRAMEWORKS: ARTIFICIAL INTELLIGENCE MARKET, BY REGION, 2025–2032 (USD BILLION)

TABLE 65

NO-CODE/LOW-CODE ML TOOLS: ARTIFICIAL INTELLIGENCE MARKET, BY REGION, 2020–2024 (USD BILLION)

TABLE 66

NO-CODE/LOW-CODE ML TOOLS: ARTIFICIAL INTELLIGENCE MARKET, BY REGION, 2025–2032 (USD BILLION)

TABLE 67

COMPUTER VISION PLATFORMS: ARTIFICIAL INTELLIGENCE MARKET, BY REGION, 2020–2024 (USD BILLION)

TABLE 68

COMPUTER VISION PLATFORMS: AI MARKET SIZE, BY REGION, 2025–2032 (USD BILLION)

TABLE 69

DATA PRE-PROCESSING TOOLS: AI MARKET GROWTH, BY REGION, 2020–2024 (USD BILLION)

TABLE 70

DATA PRE-PROCESSING TOOLS: AI MARKET SHARE, BY REGION, 2025–2032 (USD BILLION)

TABLE 71

BUSINESS INTELLIGENCE & ANALYTICS PLATFORMS: ARTIFICIAL INTELLIGENCE MARKET, BY REGION, 2020–2024 (USD BILLION)

TABLE 72

BUSINESS INTELLIGENCE & ANALYTICS PLATFORMS: AI MARKET TRENDS, BY REGION, 2025–2032 (USD BILLION)

TABLE 73

DEVELOPER PLATFORMS: ARTIFICIAL INTELLIGENCE MARKET, BY REGION, 2020–2024 (USD BILLION)

TABLE 74

DEVELOPER PLATFORMS: ARTIFICIAL INTELLIGENCE MARKET, BY REGION, 2025–2032 (USD BILLION)

TABLE 75

OTHER AI SOFTWARE: AI MARKET OUTLOOK, BY REGION, 2020–2024 (USD BILLION)

TABLE 76

OTHER AI SOFTWARE: ARTIFICIAL INTELLIGENCE MARKET, BY REGION, 2025–2032 (USD BILLION)

TABLE 77

AI MARKET FORECAST, BY SERVICE, 2020–2024 (USD BILLION)

TABLE 78

ARTIFICIAL INTELLIGENCE MARKET, BY SERVICE, 2025–2032 (USD BILLION)

TABLE 79

ARTIFICIAL INTELLIGENCE MARKET, BY CORE DATA SERVICE, 2020–2024 (USD BILLION)

TABLE 80

ARTIFICIAL INTELLIGENCE MARKET, BY CORE DATA SERVICE, 2025–2032 (USD BILLION)

TABLE 81

DATA COLLECTION & INGESTION: AI MARKET OUTLOOK, BY REGION, 2020–2024 (USD BILLION)

TABLE 82

DATA COLLECTION & INGESTION: AI MARKET TRENDS, BY REGION, 2025–2032 (USD BILLION)

TABLE 83

DATA PROCESSING & TRANSFORMATION: AI MARKET SHARE, BY REGION, 2020–2024 (USD BILLION)

TABLE 84

DATA PROCESSING & TRANSFORMATION: ARTIFICIAL INTELLIGENCE MARKET, BY REGION, 2025–2032 (USD BILLION)

TABLE 85

DATA STORAGE & MANAGEMENT: AI MARKET GROWTH, BY REGION, 2020–2024 (USD MILLION)

TABLE 86

DATA STORAGE & MANAGEMENT: ARTIFICIAL INTELLIGENCE MARKET, BY REGION, 2025–2032 (USD MILLION)

TABLE 87

DATA SECURITY & PRIVACY: ARTIFICIAL INTELLIGENCE MARKET, BY REGION, 2020–2024 (USD BILLION)

TABLE 88

DATA SECURITY & PRIVACY: AI MARKET SIZE, BY REGION, 2025–2032 (USD BILLION)

TABLE 89

DATA GOVERNANCE & QUALITY MANAGEMENT: ARTIFICIAL INTELLIGENCE MARKET, BY REGION, 2020–2024 (USD BILLION)

TABLE 90

DATA GOVERNANCE & QUALITY MANAGEMENT: ARTIFICIAL INTELLIGENCE MARKET, BY REGION, 2025–2032 (USD BILLION)

TABLE 91

DATA INTEGRATION & INTEROPERABILITY: AI MARKET FORECAST, BY REGION, 2020–2024 (USD MILLION)

TABLE 92

DATA INTEGRATION & INTEROPERABILITY: ARTIFICIAL INTELLIGENCE MARKET, BY REGION, 2025–2032 (USD MILLION)

TABLE 93

ARTIFICIAL INTELLIGENCE MARKET, BY DATA ANNOTATION & TRAINING DATA SERVICE, 2020–2024 (USD BILLION)

TABLE 94

ARTIFICIAL INTELLIGENCE MARKET, BY DATA ANNOTATION & TRAINING DATA SERVICE, 2025–2032 (USD BILLION)

TABLE 95

HUMAN-IN-THE-LOOP ANNOTATION: AI MARKET SIZE, BY REGION, 2020–2024 (USD BILLION)

TABLE 96

HUMAN-IN-THE-LOOP ANNOTATION: AI MARKET GROWTH, BY REGION, 2025–2032 (USD BILLION)

TABLE 97

AUTOMATED LABELING & AUGMENTATION: AI MARKET SHARE, BY REGION, 2020–2024 (USD MILLION)

TABLE 98

AUTOMATED LABELING & AUGMENTATION: AI MARKET TRENDS, BY REGION, 2025–2032 (USD MILLION)

TABLE 99

AI MARKET FORECAST, BY INTEGRATED SERVICE, 2020–2024 (USD BILLION)

TABLE 100

ARTIFICIAL INTELLIGENCE MARKET, BY INTEGRATED SERVICE, 2025–2032 (USD BILLION)

TABLE 101

AI MODEL DEVELOPMENT & DEPLOYMENT: AI MARKET OUTLOOK, BY REGION, 2020–2024 (USD BILLION)

TABLE 102

AI MODEL DEVELOPMENT & DEPLOYMENT: ARTIFICIAL INTELLIGENCE MARKET, BY REGION, 2025–2032 (USD BILLION)

TABLE 103

AI MODEL OPTIMIZATION & FINE-TUNING: AI MARKET SIZE, BY REGION, 2020–2024 (USD MILLION)

TABLE 104

AI MODEL OPTIMIZATION & FINE-TUNING: AI MARKET GROWTH, BY REGION, 2025–2032 (USD MILLION)

TABLE 105

AI SECURITY & COMPLIANCE SERVICES: AI MARKET SHARE, BY REGION, 2020–2024 (USD MILLION)

TABLE 106

AI SECURITY & COMPLIANCE SERVICES: AI MARKET TRENDS, BY REGION, 2025–2032 (USD MILLION)

TABLE 107

AI SOFTWARE DEVELOPMENT SERVICES: AI MARKET OUTLOOK, BY REGION, 2020–2024 (USD BILLION)

TABLE 108

AI SOFTWARE DEVELOPMENT SERVICES: ARTIFICIAL INTELLIGENCE MARKET, BY REGION, 2025–2032 (USD BILLION)

TABLE 109

SUPPORT & MAINTENANCE SERVICES: ARTIFICIAL INTELLIGENCE MARKET, BY REGION, 2020–2024 (USD BILLION)

TABLE 110

SUPPORT & MAINTENANCE SERVICES: ARTIFICIAL INTELLIGENCE MARKET, BY REGION, 2025–2032 (USD BILLION)

TABLE 111

ARTIFICIAL INTELLIGENCE MARKET, BY TECHNOLOGY, 2020–2024 (USD BILLION)

TABLE 112

AI MARKET FORECAST, BY TECHNOLOGY, 2025–2032 (USD BILLION)

TABLE 113

ARTIFICIAL INTELLIGENCE MARKET, BY MACHINE LEARNING, 2020–2024 (USD BILLION)

TABLE 114

ARTIFICIAL INTELLIGENCE MARKET, BY MACHINE LEARNING, 2025–2032 (USD BILLION)

TABLE 115

SUPERVISED LEARNING: AI MARKET SIZE, BY REGION, 2020–2024 (USD BILLION)

TABLE 116

SUPERVISED LEARNING: ARTIFICIAL INTELLIGENCE MARKET, BY REGION, 2025–2032 (USD BILLION)

TABLE 117

UNSUPERVISED LEARNING: AI MARKET SIZE, BY REGION, 2020–2024 (USD BILLION)

TABLE 118

UNSUPERVISED LEARNING: AI MARKET GROWTH, BY REGION, 2025–2032 (USD BILLION)

TABLE 119

REINFORCEMENT LEARNING: ARTIFICIAL INTELLIGENCE MARKET, BY REGION, 2020–2024 (USD BILLION)

TABLE 120

REINFORCEMENT LEARNING: AI MARKET SHARE, BY REGION, 2025–2032 (USD BILLION)

TABLE 121

ARTIFICIAL INTELLIGENCE MARKET, BY NATURAL LANGUAGE PROCESSING, 2020–2024 (USD BILLION)

TABLE 122

AI MARKET TRENDS, BY NATURAL LANGUAGE PROCESSING, 2025–2032 (USD BILLION)

TABLE 123

NATURAL LANGUAGE UNDERSTANDING: ARTIFICIAL INTELLIGENCE MARKET, BY REGION, 2020–2024 (USD BILLION)

TABLE 124

NATURAL LANGUAGE UNDERSTANDING: AI MARKET OUTLOOK, BY REGION, 2025–2032 (USD BILLION)

TABLE 125

NATURAL LANGUAGE GENERATION: AI MARKET SIZE, BY REGION, 2020–2024 (USD BILLION)

TABLE 126

NATURAL LANGUAGE GENERATION: AI MARKET GROWTH, BY REGION, 2025–2032 (USD BILLION)

TABLE 127

ARTIFICIAL INTELLIGENCE MARKET, BY COMPUTER VISION AI, 2020–2024 (USD BILLION)

TABLE 128

ARTIFICIAL INTELLIGENCE MARKET, BY COMPUTER VISION AI, 2025–2032 (USD BILLION)

TABLE 129

OBJECT DETECTION: ARTIFICIAL INTELLIGENCE MARKET, BY REGION, 2020–2024 (USD BILLION)

TABLE 130

OBJECT DETECTION: AI MARKET SHARE, BY REGION, 2025–2032 (USD BILLION)

TABLE 131

IMAGE CLASSIFICATION: ARTIFICIAL INTELLIGENCE MARKET, BY REGION, 2020–2024 (USD BILLION)

TABLE 132

IMAGE CLASSIFICATION: AI MARKET TRENDS, BY REGION, 2025–2032 (USD BILLION)

TABLE 133

SEMANTIC SEGMENTATION: AI MARKET OUTLOOK, BY REGION, 2020–2024 (USD BILLION)

TABLE 134

SEMANTIC SEGMENTATION: ARTIFICIAL INTELLIGENCE MARKET, BY REGION, 2025–2032 (USD BILLION)

TABLE 135

FACIAL RECOGNITION: ARTIFICIAL INTELLIGENCE MARKET, BY REGION, 2020–2024 (USD BILLION)

TABLE 136

FACIAL RECOGNITION: ARTIFICIAL INTELLIGENCE MARKET, BY REGION, 2025–2032 (USD BILLION)

TABLE 137

OTHER COMPUTER VISION AI: AI MARKET SIZE, BY REGION, 2020–2024 (USD BILLION)

TABLE 138

OTHER COMPUTER VISION AI: AI MARKET GROWTH, BY REGION, 2025–2032 (USD BILLION)

TABLE 139

ARTIFICIAL INTELLIGENCE MARKET, BY CONTEXT-AWARE AI, 2020–2024 (USD BILLION)

TABLE 140

ARTIFICIAL INTELLIGENCE MARKET, BY CONTEXT-AWARE AI, 2025–2032 (USD BILLION)

TABLE 141

CONTEXT-AWARE RECOMMENDATION SYSTEMS: AI MARKET SHARE, BY REGION, 2020–2024 (USD BILLION)

TABLE 142

CONTEXT-AWARE RECOMMENDATION SYSTEMS: AI MARKET TRENDS, BY REGION, 2025–2032 (USD BILLION)

TABLE 143

MULTI-MODAL AI: ARTIFICIAL INTELLIGENCE MARKET, BY REGION, 2020–2024 (USD MILLION)

TABLE 144

MULTI-MODAL AI: AI MARKET OUTLOOK, BY REGION, 2025–2032 (USD MILLION)

TABLE 145

CONTEXT-AWARE VIRTUAL ASSISTANTS: ARTIFICIAL INTELLIGENCE MARKET, BY REGION, 2020–2024 (USD BILLION)

TABLE 146

CONTEXT-AWARE VIRTUAL ASSISTANTS: ARTIFICIAL INTELLIGENCE MARKET, BY REGION, 2025–2032 (USD BILLION)

TABLE 147

ARTIFICIAL INTELLIGENCE MARKET, BY GENERATIVE AI, 2020–2024 (USD BILLION)

TABLE 148

ARTIFICIAL INTELLIGENCE MARKET, BY GENERATIVE AI, 2025–2032 (USD BILLION)

TABLE 149

ARTIFICIAL INTELLIGENCE MARKET, BY BUSINESS FUNCTION, 2020–2024 (USD BILLION)

TABLE 150

ARTIFICIAL INTELLIGENCE MARKET, BY BUSINESS FUNCTION, 2025–2032 (USD BILLION)

TABLE 151

ARTIFICIAL INTELLIGENCE MARKET, BY MARKETING & SALES, 2020–2024 (USD BILLION)

TABLE 152

ARTIFICIAL INTELLIGENCE MARKET, BY MARKETING & SALES, 2025–2032 (USD BILLION)

TABLE 153

SENTIMENT ANALYSIS: AI MARKET SIZE, BY REGION, 2020–2024 (USD BILLION)

TABLE 154

SENTIMENT ANALYSIS: AI MARKET GROWTH, BY REGION, 2025–2032 (USD BILLION)

TABLE 155

PREDICTIVE FORECASTING: AI MARKET SHARE, BY REGION, 2020–2024 (USD BILLION)

TABLE 156

PREDICTIVE FORECASTING: AI MARKET TRENDS, BY REGION, 2025–2032 (USD BILLION)

TABLE 157

CONTENT GENERATION & MARKETING: AI MARKET OUTLOOK, BY REGION, 2020–2024 (USD BILLION)

TABLE 158

CONTENT GENERATION & MARKETING: ARTIFICIAL INTELLIGENCE MARKET, BY REGION, 2025–2032 (USD BILLION)

TABLE 159

AUDIENCE SEGMENTATION & PERSONALIZATION: ARTIFICIAL INTELLIGENCE MARKET, BY REGION, 2020–2024 (USD BILLION)

TABLE 160

AUDIENCE SEGMENTATION & PERSONALIZATION: ARTIFICIAL INTELLIGENCE MARKET, BY REGION, 2025–2032 (USD BILLION)

TABLE 161

CUSTOMER EXPERIENCE MANAGEMENT: ARTIFICIAL INTELLIGENCE MARKET, BY REGION, 2020–2024 (USD BILLION)

TABLE 162

CUSTOMER EXPERIENCE MANAGEMENT: ARTIFICIAL INTELLIGENCE MARKET, BY REGION, 2025–2032 (USD BILLION)

TABLE 163

OTHER MARKETING & SALES FUNCTIONS: ARTIFICIAL INTELLIGENCE MARKET, BY REGION, 2020–2024 (USD BILLION)

TABLE 164

OTHER MARKETING & SALES FUNCTIONS: ARTIFICIAL INTELLIGENCE MARKET, BY REGION, 2025–2032 (USD BILLION)

TABLE 165

ARTIFICIAL INTELLIGENCE MARKET, BY HUMAN RESOURCES, 2020–2024 (USD BILLION)

TABLE 166

ARTIFICIAL INTELLIGENCE MARKET, BY HUMAN RESOURCES, BY REGION, 2025–2032 (USD BILLION)

TABLE 167

ONBOARDING AUTOMATION: ARTIFICIAL INTELLIGENCE MARKET, BY REGION, 2020–2024 (USD BILLION)

TABLE 168

ONBOARDING AUTOMATION: ARTIFICIAL INTELLIGENCE MARKET, BY REGION, 2025–2032 (USD BILLION)

TABLE 169

CANDIDATE SCREENING & RECRUITMENT: ARTIFICIAL INTELLIGENCE MARKET, BY REGION, 2020–2024 (USD BILLION)

TABLE 170

CANDIDATE SCREENING & RECRUITMENT: ARTIFICIAL INTELLIGENCE MARKET, BY REGION, 2025–2032 (USD BILLION)

TABLE 171

PERFORMANCE MANAGEMENT: ARTIFICIAL INTELLIGENCE MARKET, BY REGION, 2020–2024 (USD BILLION)

TABLE 172

PERFORMANCE MANAGEMENT: ARTIFICIAL INTELLIGENCE MARKET, BY REGION, 2025–2032 (USD BILLION)

TABLE 173

WORKFORCE MANAGEMENT: ARTIFICIAL INTELLIGENCE MARKET, BY REGION, 2020–2024 (USD BILLION)

TABLE 174

WORKFORCE MANAGEMENT: ARTIFICIAL INTELLIGENCE MARKET, BY REGION, 2025–2032 (USD BILLION)

TABLE 175

EMPLOYEE FEEDBACK ANALYSIS: ARTIFICIAL INTELLIGENCE MARKET, BY REGION, 2020–2024 (USD BILLION)

TABLE 176

EMPLOYEE FEEDBACK ANALYSIS: ARTIFICIAL INTELLIGENCE MARKET, BY REGION, 2025–2032 (USD BILLION)

TABLE 177

OTHER HUMAN RESOURCES FUNCTIONS: ARTIFICIAL INTELLIGENCE MARKET, BY REGION, 2020–2024 (USD BILLION)

TABLE 178

OTHER HUMAN RESOURCES FUNCTIONS: ARTIFICIAL INTELLIGENCE MARKET, BY REGION, 2025–2032 (USD BILLION)

TABLE 179

ARTIFICIAL INTELLIGENCE MARKET, BY FINANCE & ACCOUNTING, 2020–2024 (USD BILLION)

TABLE 180

ARTIFICIAL INTELLIGENCE MARKET, BY FINANCE & ACCOUNTING, 2025–2032 (USD BILLION)

TABLE 181

FINANCIAL PLANNING & FORECASTING: ARTIFICIAL INTELLIGENCE MARKET, BY REGION, 2020–2024 (USD BILLION)

TABLE 182

FINANCIAL PLANNING & FORECASTING: ARTIFICIAL INTELLIGENCE MARKET, BY REGION, 2025–2032 (USD BILLION)

TABLE 183

AUTOMATED BOOKKEEPING & RECONCILIATION: ARTIFICIAL INTELLIGENCE MARKET, BY REGION, 2020–2024 (USD BILLION)

TABLE 184

AUTOMATED BOOKKEEPING & RECONCILIATION: ARTIFICIAL INTELLIGENCE MARKET, BY REGION, 2025–2032 (USD BILLION)

TABLE 185

PROCUREMENT & SUPPLY CHAIN FINANCE: ARTIFICIAL INTELLIGENCE MARKET, BY REGION, 2020–2024 (USD BILLION)

TABLE 186

PROCUREMENT & SUPPLY CHAIN FINANCE: ARTIFICIAL INTELLIGENCE MARKET, BY REGION, 2025–2032 (USD BILLION)

TABLE 187

REVENUE CYCLE MANAGEMENT: ARTIFICIAL INTELLIGENCE MARKET, BY REGION, 2020–2024 (USD BILLION)

TABLE 188

REVENUE CYCLE MANAGEMENT: ARTIFICIAL INTELLIGENCE MARKET, BY REGION, 2025–2032 (USD BILLION)

TABLE 189

FINANCIAL COMPLIANCE & REGULATORY REPORTING: ARTIFICIAL INTELLIGENCE MARKET, BY REGION, 2020–2024 (USD BILLION)

TABLE 190

FINANCIAL COMPLIANCE & REGULATORY REPORTING: ARTIFICIAL INTELLIGENCE MARKET, BY REGION, 2025–2032 (USD BILLION)

TABLE 191

OTHER FINANCE & ACCOUNTING FUNCTIONS: ARTIFICIAL INTELLIGENCE MARKET, BY REGION, 2020–2024 (USD BILLION)

TABLE 192

OTHER FINANCE & ACCOUNTING FUNCTIONS: ARTIFICIAL INTELLIGENCE MARKET, BY REGION, 2025–2032 (USD BILLION)

TABLE 193

ARTIFICIAL INTELLIGENCE MARKET, BY OPERATIONS & SUPPLY CHAIN, 2020–2024 (USD BILLION)

TABLE 194

ARTIFICIAL INTELLIGENCE MARKET, BY OPERATIONS & SUPPLY CHAIN, 2025–2032 (USD BILLION)

TABLE 195

AIOPS: ARTIFICIAL INTELLIGENCE MARKET, BY REGION, 2020–2024 (USD MILLION)

TABLE 196

AIOPS: ARTIFICIAL INTELLIGENCE MARKET, BY REGION, 2025–2032 (USD MILLION)

TABLE 197

IT SERVICE MANAGEMENT: ARTIFICIAL INTELLIGENCE MARKET, BY REGION, 2020–2024 (USD MILLION)

TABLE 198

IT SERVICE MANAGEMENT: ARTIFICIAL INTELLIGENCE MARKET, BY REGION, 2025–2032 (USD MILLION)

TABLE 199

DEMAND PLANNING & FORECASTING: ARTIFICIAL INTELLIGENCE MARKET, BY REGION, 2020–2024 (USD BILLION)

TABLE 200

DEMAND PLANNING & FORECASTING: ARTIFICIAL INTELLIGENCE MARKET, BY REGION, 2025–2032 (USD BILLION)

TABLE 201

PROCUREMENT & SOURCING: ARTIFICIAL INTELLIGENCE MARKET, BY REGION, 2020–2024 (USD BILLION)

TABLE 202

PROCUREMENT & SOURCING: ARTIFICIAL INTELLIGENCE MARKET, BY REGION, 2025–2032 (USD BILLION)

TABLE 203

WAREHOUSE & INVENTORY MANAGEMENT: ARTIFICIAL INTELLIGENCE MARKET, BY REGION, 2020–2024 (USD BILLION)

TABLE 204

WAREHOUSE & INVENTORY MANAGEMENT: ARTIFICIAL INTELLIGENCE MARKET, BY REGION, 2025–2032 (USD BILLION)

TABLE 205

PRODUCTION PLANNING & SCHEDULING: ARTIFICIAL INTELLIGENCE MARKET, BY REGION, 2020–2024 (USD BILLION)

TABLE 206

PRODUCTION PLANNING & SCHEDULING: ARTIFICIAL INTELLIGENCE MARKET, BY REGION, 2025–2032 (USD BILLION)

TABLE 207

OTHER OPERATIONS & SUPPLY CHAIN FUNCTIONS: ARTIFICIAL INTELLIGENCE MARKET, BY REGION, 2020–2024 (USD MILLION)

TABLE 208

OTHER OPERATIONS & SUPPLY CHAIN FUNCTIONS: ARTIFICIAL INTELLIGENCE MARKET, BY REGION, 2025–2032 (USD MILLION)

TABLE 209

OTHER BUSINESS FUNCTIONS: ARTIFICIAL INTELLIGENCE MARKET, BY REGION, 2020–2024 (USD BILLION)

TABLE 210

OTHER BUSINESS FUNCTIONS: ARTIFICIAL INTELLIGENCE MARKET, BY REGION, 2025–2032 (USD BILLION)

TABLE 211

ARTIFICIAL INTELLIGENCE MARKET, BY ENTERPRISE APPLICATION, 2020–2024 (USD BILLION)

TABLE 212

ARTIFICIAL INTELLIGENCE MARKET, BY ENTERPRISE APPLICATION, 2025–2032 (USD BILLION)

TABLE 213

ENTERPRISE APPLICATION: ARTIFICIAL INTELLIGENCE MARKET, BY BFSI, 2020–2024 (USD BILLION)

TABLE 214

ENTERPRISE APPLICATION: ARTIFICIAL INTELLIGENCE MARKET, BY BFSI, 2025–2032 (USD BILLION)

TABLE 215

ENTERPRISE APPLICATIONS IN BFSI: ARTIFICIAL INTELLIGENCE MARKET, BY REGION, 2020–2024 (USD BILLION)

TABLE 216

ENTERPRISE APPLICATIONS IN BFSI: ARTIFICIAL INTELLIGENCE MARKET, BY REGION, 2025–2032 (USD BILLION)

TABLE 217

ENTERPRISE APPLICATION: ARTIFICIAL INTELLIGENCE MARKET, BY RETAIL & E-COMMERCE, 2020–2024 (USD BILLION)

TABLE 218

ENTERPRISE APPLICATION: ARTIFICIAL INTELLIGENCE MARKET, BY RETAIL & E-COMMERCE, 2025–2032 (USD BILLION)

TABLE 219

ENTERPRISE APPLICATIONS IN RETAIL & E-COMMERCE: ARTIFICIAL INTELLIGENCE MARKET, BY REGION, 2020–2024 (USD BILLION)

TABLE 220

ENTERPRISE APPLICATIONS IN RETAIL & E-COMMERCE: ARTIFICIAL INTELLIGENCE MARKET, BY REGION, 2025–2032 (USD BILLION)

TABLE 221

ENTERPRISE APPLICATION: ARTIFICIAL INTELLIGENCE MARKET, BY TRANSPORTATION & LOGISTICS, 2020–2024 (USD BILLION)

TABLE 222

ENTERPRISE APPLICATION: ARTIFICIAL INTELLIGENCE MARKET, BY TRANSPORTATION & LOGISTICS, 2025–2032 (USD BILLION)

TABLE 223

ENTERPRISE APPLICATIONS IN TRANSPORTATION & LOGISTICS: ARTIFICIAL INTELLIGENCE MARKET, BY REGION, 2020–2024 (USD BILLION)

TABLE 224

ENTERPRISE APPLICATIONS IN TRANSPORTATION & LOGISTICS: ARTIFICIAL INTELLIGENCE MARKET, BY REGION, 2025–2032 (USD BILLION)

TABLE 225

ENTERPRISE APPLICATION: ARTIFICIAL INTELLIGENCE MARKET, BY GOVERNMENT & DEFENSE, 2020–2024 (USD BILLION)

TABLE 226

ENTERPRISE APPLICATION: ARTIFICIAL INTELLIGENCE MARKET, BY GOVERNMENT & DEFENSE, 2025–2032 (USD BILLION)

TABLE 227

ENTERPRISE APPLICATIONS IN GOVERNMENT & DEFENSE: ARTIFICIAL INTELLIGENCE MARKET, BY REGION, 2020–2024 (USD BILLION)

TABLE 228

ENTERPRISE APPLICATIONS IN GOVERNMENT & DEFENSE: ARTIFICIAL INTELLIGENCE MARKET, BY REGION, 2025–2032 (USD BILLION)

TABLE 229

ENTERPRISE APPLICATION: ARTIFICIAL INTELLIGENCE MARKET, BY HEALTHCARE & LIFE SCIENCES, 2020–2024 (USD BILLION)

TABLE 230

ENTERPRISE APPLICATION: ARTIFICIAL INTELLIGENCE MARKET, BY HEALTHCARE & LIFE SCIENCES, 2025–2032 (USD BILLION)

TABLE 231

ENTERPRISE APPLICATIONS IN HEALTHCARE & LIFE SCIENCES: ARTIFICIAL INTELLIGENCE MARKET, BY REGION, 2020–2024 (USD BILLION)

TABLE 232

ENTERPRISE APPLICATIONS IN HEALTHCARE & LIFE SCIENCES: ARTIFICIAL INTELLIGENCE MARKET, BY REGION, 2025–2032 (USD BILLION)

TABLE 233

ENTERPRISE APPLICATION: ARTIFICIAL INTELLIGENCE MARKET, BY TELECOMMUNICATIONS, 2020–2024 (USD BILLION)

TABLE 234

ENTERPRISE APPLICATION: ARTIFICIAL INTELLIGENCE MARKET, BY TELECOMMUNICATIONS, 2025–2032 (USD BILLION)

TABLE 235

ENTERPRISE APPLICATIONS IN TELECOMMUNICATIONS: ARTIFICIAL INTELLIGENCE MARKET, BY REGION, 2020–2024 (USD BILLION)

TABLE 236

ENTERPRISE APPLICATIONS IN TELECOMMUNICATIONS: ARTIFICIAL INTELLIGENCE MARKET, BY REGION, 2025–2032 (USD BILLION)

TABLE 237

ENTERPRISE APPLICATION: ARTIFICIAL INTELLIGENCE MARKET, BY ENERGY & UTILITIES, 2020–2024 (USD BILLION)

TABLE 238

ENERGY & UTILITIES: ARTIFICIAL INTELLIGENCE MARKET, BY ENERGY & UTILITIES, 2025–2032 (USD BILLION)

TABLE 239

ENTERPRISE APPLICATIONS IN ENERGY & UTILITIES: ARTIFICIAL INTELLIGENCE MARKET, BY REGION, 2020–2024 (USD BILLION)

TABLE 240

ENTERPRISE APPLICATIONS IN ENERGY & UTILITIES: ARTIFICIAL INTELLIGENCE MARKET, BY REGION, 2025–2032 (USD BILLION)

TABLE 241

ENTERPRISE APPLICATION: ARTIFICIAL INTELLIGENCE MARKET, BY MANUFACTURING, 2020–2024 (USD BILLION)

TABLE 242

ENTERPRISE APPLICATION: ARTIFICIAL INTELLIGENCE MARKET, BY MANUFACTURING, 2025–2032 (USD BILLION)

TABLE 243

ENTERPRISE APPLICATIONS IN MANUFACTURING: ARTIFICIAL INTELLIGENCE MARKET, BY REGION, 2020–2024 (USD BILLION)

TABLE 244

ENTERPRISE APPLICATIONS IN MANUFACTURING: ARTIFICIAL INTELLIGENCE MARKET, BY REGION, 2025–2032 (USD BILLION)

TABLE 245

ENTERPRISE APPLICATION: ARTIFICIAL INTELLIGENCE MARKET, BY AGRICULTURE, 2020–2024 (USD BILLION)

TABLE 246

ENTERPRISE APPLICATION: ARTIFICIAL INTELLIGENCE MARKET, BY AGRICULTURE, 2025–2032 (USD BILLION)

TABLE 247

ENTERPRISE APPLICATIONS IN AGRICULTURE: ARTIFICIAL INTELLIGENCE MARKET, BY REGION, 2020–2024 (USD BILLION)

TABLE 248

ENTERPRISE APPLICATIONS IN AGRICULTURE: ARTIFICIAL INTELLIGENCE MARKET, BY REGION, 2025–2032 (USD BILLION)

TABLE 249

ENTERPRISE APPLICATION: ARTIFICIAL INTELLIGENCE MARKET, BY SOFTWARE & TECHNOLOGY PROVIDER, 2020–2024 (USD BILLION)

TABLE 250

ENTERPRISE APPLICATION: ARTIFICIAL INTELLIGENCE MARKET, BY SOFTWARE & TECHNOLOGY PROVIDER, 2025–2032 (USD BILLION)

TABLE 251

ENTERPRISE APPLICATIONS IN SOFTWARE & TECHNOLOGY PROVIDERS: ARTIFICIAL INTELLIGENCE MARKET, BY REGION, 2020–2024 (USD BILLION)

TABLE 252

ENTERPRISE APPLICATIONS IN SOFTWARE & TECHNOLOGY PROVIDERS: ARTIFICIAL INTELLIGENCE MARKET, BY REGION, 2025–2032 (USD BILLION)

TABLE 253

ENTERPRISE APPLICATION: ARTIFICIAL INTELLIGENCE MARKET, BY MEDIA AND ENTERTAINMENT, 2020–2024 (USD BILLION)

TABLE 254

ENTERPRISE APPLICATION: ARTIFICIAL INTELLIGENCE MARKET, BY MEDIA AND ENTERTAINMENT, 2025–2032 (USD BILLION)

TABLE 255

ENTERPRISE APPLICATIONS IN MEDIA AND ENTERTAINMENT: ARTIFICIAL INTELLIGENCE MARKET, BY REGION, 2020–2024 (USD BILLION)

TABLE 256

ENTERPRISE APPLICATIONS IN MEDIA AND ENTERTAINMENT: ARTIFICIAL INTELLIGENCE MARKET, BY REGION, 2025–2032 (USD BILLION)

TABLE 257

OTHER ENTERPRISE APPLICATIONS: ARTIFICIAL INTELLIGENCE MARKET, BY REGION, 2020–2024 (USD BILLION)

TABLE 258

OTHER ENTERPRISE APPLICATIONS: ARTIFICIAL INTELLIGENCE MARKET, BY REGION, 2025–2032 (USD BILLION)

TABLE 259

ARTIFICIAL INTELLIGENCE MARKET, BY END USER, 2020–2024 (USD BILLION)

TABLE 260

ARTIFICIAL INTELLIGENCE MARKET, BY END USER, 2025–2032 (USD BILLION)

TABLE 261

CONSUMERS: ARTIFICIAL INTELLIGENCE MARKET, BY REGION, 2020–2024 (USD BILLION)

TABLE 262

CONSUMERS: ARTIFICIAL INTELLIGENCE MARKET, BY REGION, 2025–2032 (USD BILLION)

TABLE 263

ARTIFICIAL INTELLIGENCE MARKET, BY ENTERPRISE, 2020–2024 (USD BILLION)

TABLE 264

ARTIFICIAL INTELLIGENCE MARKET, BY ENTERPRISE, 2025–2032 (USD BILLION)

TABLE 265

ENTERPRISES: ARTIFICIAL INTELLIGENCE MARKET, BY REGION, 2020–2024 (USD BILLION)

TABLE 266

ENTERPRISES: ARTIFICIAL INTELLIGENCE MARKET, BY REGION, 2025–2032 (USD BILLION)

TABLE 267

ARTIFICIAL INTELLIGENCE MARKET, BY BFSI, 2020–2024 (USD BILLION)

TABLE 268

ARTIFICIAL INTELLIGENCE MARKET, BY BFSI, 2025–2032 (USD BILLION)

TABLE 269

ARTIFICIAL INTELLIGENCE MARKET, BY RETAIL & E-COMMERCE, 2020–2024 (USD BILLION)

TABLE 270

ARTIFICIAL INTELLIGENCE MARKET, BY RETAIL & E-COMMERCE, 2025–2032 (USD BILLION)

TABLE 271

ARTIFICIAL INTELLIGENCE MARKET, BY TRANSPORTATION & LOGISTICS, 2020–2024 (USD BILLION)

TABLE 272

ARTIFICIAL INTELLIGENCE MARKET, BY TRANSPORTATION & LOGISTICS, 2025–2032 (USD BILLION)

TABLE 273

ARTIFICIAL INTELLIGENCE MARKET, BY GOVERNMENT & DEFENSE, 2020–2024 (USD BILLION)

TABLE 274

ARTIFICIAL INTELLIGENCE MARKET, BY GOVERNMENT & DEFENSE, 2025–2032 (USD BILLION)

TABLE 275

ARTIFICIAL INTELLIGENCE MARKET, BY HEALTHCARE & LIFE SCIENCES, 2020–2024 (USD BILLION)

TABLE 276

ARTIFICIAL INTELLIGENCE MARKET, BY HEALTHCARE & LIFE SCIENCES, 2025–2032 (USD BILLION)

TABLE 277

ARTIFICIAL INTELLIGENCE MARKET, BY TELECOMMUNICATIONS, 2020–2024 (USD BILLION)

TABLE 278

ARTIFICIAL INTELLIGENCE MARKET, BY TELECOMMUNICATIONS, 2025–2032 (USD BILLION)

TABLE 279

ARTIFICIAL INTELLIGENCE MARKET, BY ENERGY & UTILITIES, 2020–2024 (USD BILLION)

TABLE 280

ARTIFICIAL INTELLIGENCE MARKET, BY ENERGY & UTILITIES, 2025–2032 (USD BILLION)

TABLE 281

ARTIFICIAL INTELLIGENCE MARKET, BY MANUFACTURING, 2020–2024 (USD BILLION)

TABLE 282

ARTIFICIAL INTELLIGENCE MARKET, BY MANUFACTURING, 2025–2032 (USD BILLION)

TABLE 283

ARTIFICIAL INTELLIGENCE MARKET, BY SOFTWARE & TECHNOLOGY PROVIDERS, 2020–2024 (USD BILLION)

TABLE 284

ARTIFICIAL INTELLIGENCE MARKET, BY SOFTWARE & TECHNOLOGY PROVIDERS, 2025–2032 (USD BILLION)

TABLE 285

ARTIFICIAL INTELLIGENCE MARKET, BY MEDIA AND ENTERTAINMENT, 2020–2024 (USD BILLION)

TABLE 286

ARTIFICIAL INTELLIGENCE MARKET, BY MEDIA AND ENTERTAINMENT, 2025–2032 (USD BILLION)

TABLE 287

OTHER ENTERPRISES: ARTIFICIAL INTELLIGENCE MARKET, BY REGION, 2020–2024 (USD BILLION)

TABLE 288

OTHER ENTERPRISES: ARTIFICIAL INTELLIGENCE MARKET, BY REGION, 2025–2032 (USD BILLION)

TABLE 289

ARTIFICIAL INTELLIGENCE MARKET, BY REGION, 2020–2024 (USD BILLION)

TABLE 290

ARTIFICIAL INTELLIGENCE MARKET, BY REGION, 2025–2032 (USD BILLION)

TABLE 291

NORTH AMERICA: ARTIFICIAL INTELLIGENCE MARKET, BY OFFERING, 2020–2024 (USD BILLION)

TABLE 292

NORTH AMERICA: ARTIFICIAL INTELLIGENCE MARKET, BY OFFERING, 2025–2032 (USD BILLION)

TABLE 293

NORTH AMERICA: ARTIFICIAL INTELLIGENCE MARKET, BY INFRASTRUCTURE, 2020–2024 (USD BILLION)

TABLE 294

NORTH AMERICA: ARTIFICIAL INTELLIGENCE MARKET, BY INFRASTRUCTURE, 2025–2032 (USD BILLION)

TABLE 295

NORTH AMERICA: ARTIFICIAL INTELLIGENCE MARKET, BY INFRASTRUCTURE FUNCTION, 2020–2024 (USD BILLION)

TABLE 296

NORTH AMERICA: ARTIFICIAL INTELLIGENCE MARKET, BY INFRASTRUCTURE FUNCTION, 2025–2032 (USD BILLION)

TABLE 297

NORTH AMERICA: ARTIFICIAL INTELLIGENCE MARKET, BY SOFTWARE, 2020–2024 (USD BILLION)

TABLE 298

NORTH AMERICA: ARTIFICIAL INTELLIGENCE MARKET, BY SOFTWARE, 2025–2032 (USD BILLION)

TABLE 299

NORTH AMERICA: ARTIFICIAL INTELLIGENCE MARKET, BY SERVICE, 2020–2024 (USD BILLION)

TABLE 300

NORTH AMERICA: ARTIFICIAL INTELLIGENCE MARKET, BY SERVICE, 2025–2032 (USD BILLION)

TABLE 301

NORTH AMERICA: ARTIFICIAL INTELLIGENCE MARKET, BY TECHNOLOGY, 2020–2024 (USD BILLION)

TABLE 302

NORTH AMERICA: ARTIFICIAL INTELLIGENCE MARKET, BY TECHNOLOGY, 2025–2032 (USD BILLION)

TABLE 303

NORTH AMERICA: ARTIFICIAL INTELLIGENCE MARKET, BY BUSINESS FUNCTION, 2020–2024 (USD BILLION)

TABLE 304

NORTH AMERICA: ARTIFICIAL INTELLIGENCE MARKET, BY BUSINESS FUNCTION, 2025–2032 (USD BILLION)

TABLE 305

NORTH AMERICA: ARTIFICIAL INTELLIGENCE MARKET, BY BFSI APPLICATION, 2020–2024 (USD BILLION)

TABLE 306

NORTH AMERICA: ARTIFICIAL INTELLIGENCE MARKET, BY BFSI APPLICATION, 2025–2032 (USD BILLION)

TABLE 307

NORTH AMERICA: ARTIFICIAL INTELLIGENCE MARKET, BY RETAIL & E-COMMERCE APPLICATION, 2020–2024 (USD BILLION)

TABLE 308

NORTH AMERICA: ARTIFICIAL INTELLIGENCE MARKET, BY RETAIL & E-COMMERCE APPLICATION, 2025–2032 (USD BILLION)

TABLE 309

NORTH AMERICA: ARTIFICIAL INTELLIGENCE MARKET, BY MANUFACTURING APPLICATION, 2020–2024 (USD BILLION)

TABLE 310

NORTH AMERICA: ARTIFICIAL INTELLIGENCE MARKET, BY MANUFACTURING APPLICATION, 2025–2032 (USD BILLION)

TABLE 311

NORTH AMERICA: ARTIFICIAL INTELLIGENCE MARKET, BY GOVERNMENT & DEFENSE APPLICATION, 2020–2024 (USD BILLION)

TABLE 312

NORTH AMERICA: ARTIFICIAL INTELLIGENCE MARKET, BY GOVERNMENT & DEFENSE APPLICATION, 2025–2032 (USD BILLION)

TABLE 313

NORTH AMERICA: ARTIFICIAL INTELLIGENCE MARKET, BY HEALTHCARE AND LIFE SCIENCES APPLICATION, 2020–2024 (USD BILLION)

TABLE 314

NORTH AMERICA: ARTIFICIAL INTELLIGENCE MARKET, BY HEALTHCARE AND LIFE SCIENCES APPLICATION, 2025–2032 (USD BILLION)

TABLE 315

NORTH AMERICA: ARTIFICIAL INTELLIGENCE MARKET, BY TELECOMMUNICATIONS APPLICATION, 2020–2024 (USD BILLION)

TABLE 316

NORTH AMERICA: ARTIFICIAL INTELLIGENCE MARKET, BY TELECOMMUNICATIONS APPLICATION, 2025–2032 (USD BILLION)

TABLE 317

NORTH AMERICA: ARTIFICIAL INTELLIGENCE MARKET, BY ENERGY & UTILITIES APPLICATION, 2020–2024 (USD BILLION)

TABLE 318

NORTH AMERICA: ARTIFICIAL INTELLIGENCE MARKET, BY ENERGY & UTILITIES APPLICATION, 2025–2032 (USD BILLION)

TABLE 319

NORTH AMERICA: ARTIFICIAL INTELLIGENCE MARKET, BY TRANSPORTATION AND LOGISTICS APPLICATION, 2020–2024 (USD BILLION)

TABLE 320

NORTH AMERICA: ARTIFICIAL INTELLIGENCE MARKET, BY TRANSPORTATION AND LOGISTICS APPLICATION, 2025–2032 (USD BILLION)

TABLE 321

NORTH AMERICA: ARTIFICIAL INTELLIGENCE MARKET, BY AGRICULTURE APPLICATION, 2020–2024 (USD BILLION)

TABLE 322

NORTH AMERICA: ARTIFICIAL INTELLIGENCE MARKET, BY AGRICULTURE APPLICATION, 2025–2032 (USD BILLION)

TABLE 323

NORTH AMERICA: ARTIFICIAL INTELLIGENCE MARKET, BY SOFTWARE & TECHNOLOGY PROVIDERS APPLICATION, 2020–2024 (USD BILLION)

TABLE 324

NORTH AMERICA: ARTIFICIAL INTELLIGENCE MARKET, BY SOFTWARE & TECHNOLOGY PROVIDERS APPLICATION, 2025–2032 (USD BILLION)

TABLE 325

NORTH AMERICA: ARTIFICIAL INTELLIGENCE MARKET, BY MEDIA & ENTERTAINMENT APPLICATION, 2020–2024 (USD BILLION)

TABLE 326

NORTH AMERICA: ARTIFICIAL INTELLIGENCE MARKET, BY MEDIA & ENTERTAINMENT APPLICATION, 2025–2032 (USD BILLION)

TABLE 327

NORTH AMERICA: ARTIFICIAL INTELLIGENCE MARKET, BY END USER, 2020–2024 (USD BILLION)

TABLE 328

NORTH AMERICA: ARTIFICIAL INTELLIGENCE MARKET, BY END USER, 2025–2032 (USD BILLION)

TABLE 329

NORTH AMERICA: ARTIFICIAL INTELLIGENCE MARKET, BY ENTERPRISE END USER, 2020–2024 (USD BILLION)

TABLE 330

NORTH AMERICA: ARTIFICIAL INTELLIGENCE MARKET, BY ENTERPRISE END USER, 2025–2032 (USD BILLION)

TABLE 331

NORTH AMERICA: ARTIFICIAL INTELLIGENCE MARKET, BY BFSI END USER, 2020–2024 (USD BILLION)

TABLE 332

NORTH AMERICA: ARTIFICIAL INTELLIGENCE MARKET, BY BFSI END USER, 2025–2032 (USD BILLION)

TABLE 333

NORTH AMERICA: ARTIFICIAL INTELLIGENCE MARKET, BY RETAIL & E-COMMERCE END USER, 2020–2024 (USD BILLION)

TABLE 334

NORTH AMERICA: ARTIFICIAL INTELLIGENCE MARKET, BY RETAIL & E-COMMERCE END USER, 2025–2032 (USD BILLION)

TABLE 335

NORTH AMERICA: ARTIFICIAL INTELLIGENCE MARKET, BY MANUFACTURING END USER, 2020–2024 (USD BILLION)

TABLE 336

NORTH AMERICA: ARTIFICIAL INTELLIGENCE MARKET, BY MANUFACTURING END USER, 2025–2032 (USD BILLION)

TABLE 337

NORTH AMERICA: ARTIFICIAL INTELLIGENCE MARKET, BY GOVERNMENT & DEFENSE END USER, 2020–2024 (USD BILLION)

TABLE 338

NORTH AMERICA: ARTIFICIAL INTELLIGENCE MARKET, BY GOVERNMENT & DEFENSE END USER, 2025–2032 (USD BILLION)

TABLE 339

NORTH AMERICA: ARTIFICIAL INTELLIGENCE MARKET, BY HEALTHCARE AND LIFE SCIENCES END USER, 2020–2024 (USD BILLION)

TABLE 340

NORTH AMERICA: ARTIFICIAL INTELLIGENCE MARKET, BY HEALTHCARE AND LIFE SCIENCES END USER, 2025–2032 (USD BILLION)

TABLE 341

NORTH AMERICA: ARTIFICIAL INTELLIGENCE MARKET, BY TELECOMMUNICATIONS END USER, 2020–2024 (USD BILLION)

TABLE 342

NORTH AMERICA: ARTIFICIAL INTELLIGENCE MARKET, BY TELECOMMUNICATIONS END USER, 2025–2032 (USD BILLION)

TABLE 343

NORTH AMERICA: ARTIFICIAL INTELLIGENCE MARKET, BY ENERGY & UTILITIES END USER, 2020–2024 (USD BILLION)

TABLE 344

NORTH AMERICA: ARTIFICIAL INTELLIGENCE MARKET, BY ENERGY & UTILITIES END USER, 2025–2032 (USD BILLION)

TABLE 345

NORTH AMERICA: ARTIFICIAL INTELLIGENCE MARKET, BY TRANSPORTATION AND LOGISTICS END USER, 2020–2024 (USD BILLION)

TABLE 346

NORTH AMERICA: ARTIFICIAL INTELLIGENCE MARKET, BY TRANSPORTATION AND LOGISTICS END USER, 2025–2032 (USD BILLION)

TABLE 347

NORTH AMERICA: ARTIFICIAL INTELLIGENCE MARKET, BY SOFTWARE & TECHNOLOGY PROVIDERS END USER, 2020–2024 (USD BILLION)

TABLE 348

NORTH AMERICA: ARTIFICIAL INTELLIGENCE MARKET, BY SOFTWARE & TECHNOLOGY PROVIDERS END USER, 2025–2032 (USD BILLION)

TABLE 349

NORTH AMERICA: ARTIFICIAL INTELLIGENCE MARKET, BY MEDIA & ENTERTAINMENT END USER, 2020–2024 (USD BILLION)

TABLE 350

NORTH AMERICA: ARTIFICIAL INTELLIGENCE MARKET, BY MEDIA & ENTERTAINMENT END USER, 2025–2032 (USD BILLION)

TABLE 351

NORTH AMERICA: ARTIFICIAL INTELLIGENCE MARKET, BY COUNTRY, 2020–2024 (USD BILLION)

TABLE 352

NORTH AMERICA: ARTIFICIAL INTELLIGENCE MARKET, BY COUNTRY, 2025–2032 (USD BILLION)

TABLE 353

US: ARTIFICIAL INTELLIGENCE MARKET, BY OFFERING, 2020–2024 (USD BILLION)

TABLE 354

US: ARTIFICIAL INTELLIGENCE MARKET, BY OFFERING, 2025–2032 (USD BILLION)

TABLE 355

CANADA: ARTIFICIAL INTELLIGENCE MARKET, BY OFFERING, 2020–2024 (USD BILLION)

TABLE 356

CANADA: ARTIFICIAL INTELLIGENCE MARKET, BY OFFERING, 2025–2032 (USD BILLION)

TABLE 357

EUROPE: ARTIFICIAL INTELLIGENCE MARKET, BY OFFERING, 2020–2024 (USD BILLION)

TABLE 358

EUROPE: ARTIFICIAL INTELLIGENCE MARKET, BY OFFERING, 2025–2032 (USD BILLION)

TABLE 359

EUROPE: ARTIFICIAL INTELLIGENCE MARKET, BY INFRASTRUCTURE, 2020–2024 (USD BILLION)

TABLE 360

EUROPE: ARTIFICIAL INTELLIGENCE MARKET, BY INFRASTRUCTURE, 2025–2032 (USD BILLION)

TABLE 361

EUROPE: ARTIFICIAL INTELLIGENCE MARKET, BY INFRASTRUCTURE FUNCTION, 2020–2024 (USD BILLION)

TABLE 362

EUROPE: ARTIFICIAL INTELLIGENCE MARKET, BY INFRASTRUCTURE FUNCTION, 2025–2032 (USD BILLION)

TABLE 363

EUROPE: ARTIFICIAL INTELLIGENCE MARKET, BY SOFTWARE, 2020–2024 (USD BILLION)

TABLE 364

EUROPE: ARTIFICIAL INTELLIGENCE MARKET, BY SOFTWARE, 2025–2032 (USD BILLION)

TABLE 365

EUROPE: ARTIFICIAL INTELLIGENCE MARKET, BY SERVICE, 2020–2024 (USD BILLION)

TABLE 366

EUROPE: ARTIFICIAL INTELLIGENCE MARKET, BY SERVICE, 2025–2032 (USD BILLION)

TABLE 367

EUROPE: ARTIFICIAL INTELLIGENCE MARKET, BY TECHNOLOGY, 2020–2024 (USD BILLION)

TABLE 368

EUROPE: ARTIFICIAL INTELLIGENCE MARKET, BY TECHNOLOGY, 2025–2032 (USD BILLION)

TABLE 369

EUROPE: ARTIFICIAL INTELLIGENCE MARKET, BY BUSINESS FUNCTION, 2020–2024 (USD BILLION)

TABLE 370

EUROPE: ARTIFICIAL INTELLIGENCE MARKET, BY BUSINESS FUNCTION, 2025–2032 (USD BILLION)

TABLE 371

EUROPE: ARTIFICIAL INTELLIGENCE MARKET, BY BFSI APPLICATION, 2020–2024 (USD BILLION)

TABLE 372

EUROPE: ARTIFICIAL INTELLIGENCE MARKET, BY BFSI APPLICATION, 2025–2032 (USD BILLION)

TABLE 373

EUROPE: ARTIFICIAL INTELLIGENCE MARKET, BY RETAIL & E-COMMERCE APPLICATION, 2020–2024 (USD BILLION)

TABLE 374

EUROPE: ARTIFICIAL INTELLIGENCE MARKET, BY RETAIL & E-COMMERCE APPLICATION, 2025–2032 (USD BILLION)

TABLE 375

EUROPE: ARTIFICIAL INTELLIGENCE MARKET, BY MANUFACTURING APPLICATION, 2020–2024 (USD BILLION)

TABLE 376

EUROPE: ARTIFICIAL INTELLIGENCE MARKET, BY MANUFACTURING APPLICATION, 2025–2032 (USD BILLION)

TABLE 377

EUROPE: ARTIFICIAL INTELLIGENCE MARKET, BY GOVERNMENT & DEFENSE APPLICATION, 2020–2024 (USD MILLION)

TABLE 378

EUROPE: ARTIFICIAL INTELLIGENCE MARKET, BY GOVERNMENT & DEFENSE APPLICATION, 2025–2032 (USD MILLION)

TABLE 379

EUROPE: ARTIFICIAL INTELLIGENCE MARKET, BY HEALTHCARE AND LIFE SCIENCES APPLICATION, 2020–2024 (USD BILLION)

TABLE 380

EUROPE: ARTIFICIAL INTELLIGENCE MARKET, BY HEALTHCARE AND LIFE SCIENCES APPLICATION, 2025–2032 (USD BILLION)

TABLE 381

EUROPE: ARTIFICIAL INTELLIGENCE MARKET, BY TELECOMMUNICATIONS APPLICATION, 2020–2024 (USD BILLION)

TABLE 382

EUROPE: ARTIFICIAL INTELLIGENCE MARKET, BY TELECOMMUNICATIONS APPLICATION, 2025–2032 (USD BILLION)

TABLE 383

EUROPE: ARTIFICIAL INTELLIGENCE MARKET, BY ENERGY & UTILITIES APPLICATION, 2020–2024 (USD MILLION)

TABLE 384

EUROPE: ARTIFICIAL INTELLIGENCE MARKET, BY ENERGY & UTILITIES APPLICATION, 2025–2032 (USD MILLION)

TABLE 385

EUROPE: ARTIFICIAL INTELLIGENCE MARKET, BY TRANSPORTATION AND LOGISTICS APPLICATION, 2020–2024 (USD BILLION)

TABLE 386

EUROPE: ARTIFICIAL INTELLIGENCE MARKET, BY TRANSPORTATION AND LOGISTICS APPLICATION, 2025–2032 (USD BILLION)

TABLE 387

EUROPE: ARTIFICIAL INTELLIGENCE MARKET, BY AGRICULTURE APPLICATION, 2020–2024 (USD BILLION)

TABLE 388

EUROPE: ARTIFICIAL INTELLIGENCE MARKET, BY AGRICULTURE APPLICATION, 2025–2032 (USD BILLION)

TABLE 389

EUROPE: ARTIFICIAL INTELLIGENCE MARKET, BY SOFTWARE & TECHNOLOGY PROVIDERS APPLICATION, 2020–2024 (USD BILLION)

TABLE 390

EUROPE: ARTIFICIAL INTELLIGENCE MARKET, BY SOFTWARE & TECHNOLOGY PROVIDERS APPLICATION, 2025–2032 (USD BILLION)

TABLE 391

EUROPE: ARTIFICIAL INTELLIGENCE MARKET, BY MEDIA & ENTERTAINMENT APPLICATION, 2020–2024 (USD BILLION)

TABLE 392

EUROPE: ARTIFICIAL INTELLIGENCE MARKET, BY MEDIA & ENTERTAINMENT APPLICATION, 2025–2032 (USD BILLION)

TABLE 393

EUROPE: ARTIFICIAL INTELLIGENCE MARKET, BY END USER, 2020–2024 (USD BILLION)

TABLE 394

EUROPE: ARTIFICIAL INTELLIGENCE MARKET, BY END USER, 2025–2032 (USD BILLION)

TABLE 395

EUROPE: ARTIFICIAL INTELLIGENCE MARKET, BY ENTERPRISE END USER, 2020–2024 (USD BILLION)

TABLE 396

EUROPE: ARTIFICIAL INTELLIGENCE MARKET, BY ENTERPRISE END USER, 2025–2032 (USD BILLION)

TABLE 397

EUROPE: ARTIFICIAL INTELLIGENCE MARKET, BY BFSI END USER, 2020–2024 (USD BILLION)

TABLE 398

EUROPE: ARTIFICIAL INTELLIGENCE MARKET, BY BFSI END USER, 2025–2032 (USD BILLION)

TABLE 399

EUROPE: ARTIFICIAL INTELLIGENCE MARKET, BY RETAIL & E-COMMERCE END USER, 2020–2024 (USD BILLION)

TABLE 400

EUROPE: ARTIFICIAL INTELLIGENCE MARKET, BY RETAIL & E-COMMERCE END USER, 2025–2032 (USD BILLION)

TABLE 401

EUROPE: ARTIFICIAL INTELLIGENCE MARKET, BY MANUFACTURING END USER, 2020–2024 (USD BILLION)

TABLE 402

EUROPE: ARTIFICIAL INTELLIGENCE MARKET, BY MANUFACTURING END USER, 2025–2032 (USD BILLION)

TABLE 403

EUROPE: ARTIFICIAL INTELLIGENCE MARKET, BY GOVERNMENT & DEFENSE END USER, 2020–2024 (USD BILLION)

TABLE 404

EUROPE: ARTIFICIAL INTELLIGENCE MARKET, BY GOVERNMENT & DEFENSE END USER, 2025–2032 (USD BILLION)

TABLE 405

EUROPE: ARTIFICIAL INTELLIGENCE MARKET, BY HEALTHCARE AND LIFE SCIENCES END USER, 2020–2024 (USD BILLION)

TABLE 406

EUROPE: ARTIFICIAL INTELLIGENCE MARKET, BY HEALTHCARE AND LIFE SCIENCES END USER, 2025–2032 (USD BILLION)

TABLE 407

EUROPE: ARTIFICIAL INTELLIGENCE MARKET, BY TELECOMMUNICATIONS END USER, 2020–2024 (USD BILLION)

TABLE 408

EUROPE: ARTIFICIAL INTELLIGENCE MARKET, BY TELECOMMUNICATIONS END USER, 2025–2032 (USD BILLION)

TABLE 409

EUROPE: ARTIFICIAL INTELLIGENCE MARKET, BY ENERGY & UTILITIES END USER, 2020–2024 (USD BILLION)

TABLE 410

EUROPE: ARTIFICIAL INTELLIGENCE MARKET, BY ENERGY & UTILITIES END USER, 2025–2032 (USD BILLION)

TABLE 411

EUROPE: ARTIFICIAL INTELLIGENCE MARKET, BY TRANSPORTATION AND LOGISTICS END USER, 2020–2024 (USD BILLION)

TABLE 412

EUROPE: ARTIFICIAL INTELLIGENCE MARKET, BY TRANSPORTATION AND LOGISTICS END USER, 2025–2032 (USD BILLION)

TABLE 413

EUROPE: ARTIFICIAL INTELLIGENCE MARKET, BY SOFTWARE & TECHNOLOGY PROVIDERS END USER, 2020–2024 (USD BILLION)

TABLE 414

EUROPE: ARTIFICIAL INTELLIGENCE MARKET, BY SOFTWARE & TECHNOLOGY PROVIDERS END USER, 2025–2032 (USD BILLION)

TABLE 415

EUROPE: ARTIFICIAL INTELLIGENCE MARKET, BY MEDIA & ENTERTAINMENT END USER, 2020–2024 (USD BILLION)

TABLE 416

EUROPE: ARTIFICIAL INTELLIGENCE MARKET, BY MEDIA & ENTERTAINMENT END USER, 2025–2032 (USD BILLION)

TABLE 417

EUROPE: ARTIFICIAL INTELLIGENCE MARKET, BY COUNTRY, 2020–2024 (USD BILLION)

TABLE 418

EUROPE: ARTIFICIAL INTELLIGENCE MARKET, BY COUNTRY, 2025–2032 (USD BILLION)

TABLE 419

UK: ARTIFICIAL INTELLIGENCE MARKET, BY OFFERING, 2020–2024 (USD BILLION)

TABLE 420

UK: ARTIFICIAL INTELLIGENCE MARKET, BY OFFERING, 2025–2032 (USD BILLION)

TABLE 421

GERMANY: ARTIFICIAL INTELLIGENCE MARKET, BY OFFERING, 2020–2024 (USD BILLION)

TABLE 422

GERMANY: ARTIFICIAL INTELLIGENCE MARKET, BY OFFERING, 2025–2032 (USD BILLION)

TABLE 423

FRANCE: ARTIFICIAL INTELLIGENCE MARKET, BY OFFERING, 2020–2024 (USD BILLION)

TABLE 424

FRANCE: ARTIFICIAL INTELLIGENCE MARKET, BY OFFERING, 2025–2032 (USD BILLION)

TABLE 425

ITALY: ARTIFICIAL INTELLIGENCE MARKET, BY OFFERING, 2020–2024 (USD BILLION)

TABLE 426

ITALY: ARTIFICIAL INTELLIGENCE MARKET, BY OFFERING, 2025–2032 (USD BILLION)

TABLE 427

SPAIN: ARTIFICIAL INTELLIGENCE MARKET, BY OFFERING, 2020–2024 (USD BILLION)

TABLE 428

SPAIN: ARTIFICIAL INTELLIGENCE MARKET, BY OFFERING, 2025–2032 (USD BILLION)

TABLE 429

NORDICS: ARTIFICIAL INTELLIGENCE MARKET, BY OFFERING, 2020–2024 (USD BILLION)

TABLE 430

NORDICS: ARTIFICIAL INTELLIGENCE MARKET, BY OFFERING, 2025–2032 (USD BILLION)

TABLE 431

BENELUX: ARTIFICIAL INTELLIGENCE MARKET, BY OFFERING, 2020–2024 (USD BILLION)

TABLE 432

BENELUX: ARTIFICIAL INTELLIGENCE MARKET, BY OFFERING, 2025–2032 (USD BILLION)

TABLE 433

RUSSIA: ARTIFICIAL INTELLIGENCE MARKET, BY OFFERING, 2020–2024 (USD BILLION)

TABLE 434

RUSSIA: ARTIFICIAL INTELLIGENCE MARKET, BY OFFERING, 2025–2032 (USD BILLION)

TABLE 435

REST OF EUROPE: ARTIFICIAL INTELLIGENCE MARKET, BY OFFERING, 2020–2024 (USD BILLION)

TABLE 436

REST OF EUROPE: ARTIFICIAL INTELLIGENCE MARKET, BY OFFERING, 2025–2032 (USD BILLION)

TABLE 437

ASIA PACIFIC: ARTIFICIAL INTELLIGENCE MARKET, BY OFFERING, 2020–2024 (USD BILLION)

TABLE 438

ASIA PACIFIC: ARTIFICIAL INTELLIGENCE MARKET, BY OFFERING, 2025–2032 (USD BILLION)

TABLE 439

ASIA PACIFIC: ARTIFICIAL INTELLIGENCE MARKET, BY INFRASTRUCTURE, 2020–2024 (USD BILLION)

TABLE 440

ASIA PACIFIC: ARTIFICIAL INTELLIGENCE MARKET, BY INFRASTRUCTURE, 2025–2032 (USD BILLION)

TABLE 441

ASIA PACIFIC: ARTIFICIAL INTELLIGENCE MARKET, BY INFRASTRUCTURE FUNCTION, 2020–2024 (USD BILLION)

TABLE 442

ASIA PACIFIC: ARTIFICIAL INTELLIGENCE MARKET, BY INFRASTRUCTURE FUNCTION, 2025–2032 (USD BILLION)

TABLE 443

ASIA PACIFIC: ARTIFICIAL INTELLIGENCE MARKET, BY SOFTWARE, 2020–2024 (USD BILLION)

TABLE 444

ASIA PACIFIC: ARTIFICIAL INTELLIGENCE MARKET, BY SOFTWARE, 2025–2032 (USD BILLION)

TABLE 445

ASIA PACIFIC: ARTIFICIAL INTELLIGENCE MARKET, BY SERVICE, 2020–2024 (USD BILLION)

TABLE 446

ASIA PACIFIC: ARTIFICIAL INTELLIGENCE MARKET, BY SERVICE, 2025–2032 (USD BILLION)

TABLE 447

ASIA PACIFIC: ARTIFICIAL INTELLIGENCE MARKET, BY TECHNOLOGY, 2020–2024 (USD BILLION)

TABLE 448

ASIA PACIFIC: ARTIFICIAL INTELLIGENCE MARKET, BY TECHNOLOGY, 2025–2032 (USD BILLION)

TABLE 449

ASIA PACIFIC: ARTIFICIAL INTELLIGENCE MARKET, BY BUSINESS FUNCTION, 2020–2024 (USD BILLION)

TABLE 450

ASIA PACIFIC: ARTIFICIAL INTELLIGENCE MARKET, BY BUSINESS FUNCTION, 2025–2032 (USD BILLION)

TABLE 451

ASIA PACIFIC: ARTIFICIAL INTELLIGENCE MARKET, BY BFSI APPLICATION, 2020–2024 (USD BILLION)

TABLE 452

ASIA PACIFIC: ARTIFICIAL INTELLIGENCE MARKET, BY BFSI APPLICATION, 2025–2032 (USD BILLION)

TABLE 453

ASIA PACIFIC: ARTIFICIAL INTELLIGENCE MARKET, BY RETAIL & E-COMMERCE APPLICATION, 2020–2024 (USD BILLION)

TABLE 454

ASIA PACIFIC: ARTIFICIAL INTELLIGENCE MARKET, BY RETAIL & E-COMMERCE APPLICATION, 2025–2032 (USD BILLION)

TABLE 455

ASIA PACIFIC: ARTIFICIAL INTELLIGENCE MARKET, BY MANUFACTURING APPLICATION, 2020–2024 (USD BILLION)

TABLE 456

ASIA PACIFIC: ARTIFICIAL INTELLIGENCE MARKET, BY MANUFACTURING APPLICATION, 2025–2032 (USD BILLION)

TABLE 457

ASIA PACIFIC: ARTIFICIAL INTELLIGENCE MARKET, BY GOVERNMENT & DEFENSE APPLICATION, 2020–2024 (USD BILLION)

TABLE 458

ASIA PACIFIC: ARTIFICIAL INTELLIGENCE MARKET, BY GOVERNMENT & DEFENSE APPLICATION, 2025–2032 (USD BILLION)

TABLE 459

ASIA PACIFIC: ARTIFICIAL INTELLIGENCE MARKET, BY HEALTHCARE AND LIFE SCIENCES APPLICATION, 2020–2024 (USD BILLION)

TABLE 460

ASIA PACIFIC: ARTIFICIAL INTELLIGENCE MARKET, BY HEALTHCARE AND LIFE SCIENCES APPLICATION, 2025–2032 (USD BILLION)

TABLE 461

ASIA PACIFIC: ARTIFICIAL INTELLIGENCE MARKET, BY TELECOMMUNICATIONS APPLICATION, 2020–2024 (USD BILLION)

TABLE 462

ASIA PACIFIC: ARTIFICIAL INTELLIGENCE MARKET, BY TELECOMMUNICATIONS APPLICATION, 2025–2032 (USD BILLION)

TABLE 463

ASIA PACIFIC: ARTIFICIAL INTELLIGENCE MARKET, BY ENERGY & UTILITIES APPLICATION, 2020–2024 (USD BILLION)

TABLE 464

ASIA PACIFIC: ARTIFICIAL INTELLIGENCE MARKET, BY ENERGY & UTILITIES APPLICATION, 2025–2032 (USD BILLION)

TABLE 465

ASIA PACIFIC: ARTIFICIAL INTELLIGENCE MARKET, BY TRANSPORTATION AND LOGISTICS APPLICATION, 2020–2024 (USD MILLION)

TABLE 466

ASIA PACIFIC: ARTIFICIAL INTELLIGENCE MARKET, BY TRANSPORTATION AND LOGISTICS APPLICATION, 2025–2032 (USD MILLION)

TABLE 467

ASIA PACIFIC: ARTIFICIAL INTELLIGENCE MARKET, BY AGRICULTURE APPLICATION, 2020–2024 (USD MILLION)

TABLE 468

ASIA PACIFIC: ARTIFICIAL INTELLIGENCE MARKET, BY AGRICULTURE APPLICATION, 2025–2032 (USD MILLION)

TABLE 469

ASIA PACIFIC: ARTIFICIAL INTELLIGENCE MARKET, BY SOFTWARE & TECHNOLOGY PROVIDERS APPLICATION, 2020–2024 (USD BILLION)

TABLE 470

ASIA PACIFIC: ARTIFICIAL INTELLIGENCE MARKET, BY SOFTWARE & TECHNOLOGY PROVIDERS APPLICATION, 2025–2032 (USD BILLION)

TABLE 471

ASIA PACIFIC: ARTIFICIAL INTELLIGENCE MARKET, BY MEDIA & ENTERTAINMENT APPLICATION, 2020–2024 (USD BILLION)

TABLE 472